How To: Commit a Tax Return when using Country Specific VAT

This How To explains how to commit a Tax Return when using Country Specific VAT.

- Open an Accounts screen.

- Open the

[ Tax (VAT) | Tax Register ]tab. - Select the period you wish to include on the VAT Return:

- Monthly:

- Click on the Monthly radio button.

- Select the month and year from the Monthly radio button.

- Quarterly:

- Click on the Quarterly radio button. You may not have to do this as this is the default.

- Select the appropriate period from the drop-down list - this will be the last month of the period that you wish to report on. For example, to start the VAT Return process for April, May and June of 2022, select June 2022.

- Monthly:

- Select the country from the dropdown list.

- Click on the GO button.

- If there are new or previously excluded transactions prior to the period that you're reporting on, the system will prompt to include these as follows:

"Do you wish to include uncommitted transactions from previous periods?"

Click Yes to include the transactions in this return. - If there are new or previously excluded transactions two or more tax periods old, the system will prompt to include these as follows:

"There are uncommitted transactions from 3 months ago or more, do you wish to include these as well?"

Click Yes to include the transactions in this return. - The country and the country's reference will be displayed in the Tax Register's grid.

- If there are new or previously excluded transactions prior to the period that you're reporting on, the system will prompt to include these as follows:

- Right click and from the context menu select Commit Return For Country Tax.

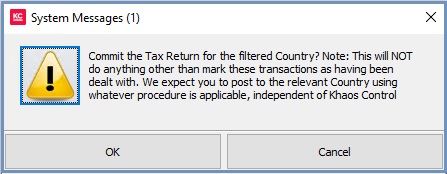

- Read the message and acknowledge the warning by clicking on the yellow triangle.

- Click OK.

Note: there are no further options when committing foreign VAT as there are with the UK return systems.

See Also

- How To: Exclude Items from a VAT Return

- How To: Review Items Excluded from a VAT Return

- How To: Use the Advanced Processing Method for VAT Returns

- Accounts overview