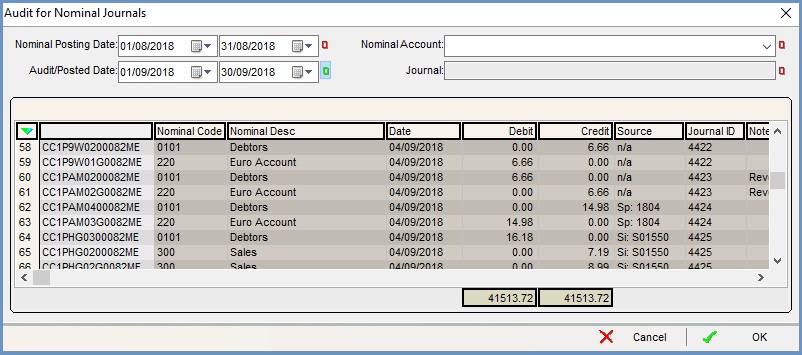

Audit for Nominal Journals Dialog

- WARNING: Auditing the system is an Advanced User feature and requires Audit Permission ticked in User Permissions.

The Audit for Nominal Journals dialog is accessed from the Other Actions Menu in the Accounts screen. It allows users to view the audit history of journal entries, for example if you wish to view changes in a nominal between specified date ranges, see How To: View Changes in a Nominal between Date Ranges.

The dialog consists of the top filters and the grid below.

Filters

- Nominal Posting Date (default=Off): the date the entry affected the accounts.

- Audit/Posted Date (default=On): the date/time when the transaction was physically posted, for example the tax point for a sales invoice.

Notes:- The dates are not always the same, especially for reversals / invoices.

- The default date range is for one day.

- User (default=Off): filter by the user who performed a transaction.

- Nominal Account (default=Off): filter the grid by the journal. The drop down lists all the nominal accounts on the system.

- Journal (default=Off): filter the grid by the journal ID.

Grid

- Unnamed: the unique ID for the entry.

- Nominal Code: the nominal code.

- Nominal Desc: the nominal description.

- Date: the date the journal was posted.

- Debit and Credit: the amount either going into or out of the account.

- Source: where the entry has originated from for example SP Ledger, sales invoice etc.

- Journal ID: the journal ID number for the entry.

- Note: a note which can be added or edited via the context menu or may come from the Description in the SP Ledger for the entry.

- Sk: the stock code number if appropriate.

- CU / SU Code: the customer or supplier URN.

- Classification: the nominal classification assigned to the entry. Nominal Classifications are used for grouping transactions for analysis purposes, see Nominal Classifications.

The following columns can be added into the grid using Grid Configuration. They are hidden by default. Please see Grid Configuration for more details:

- Post Date: the date when the transaction was physically posted

- Post Time: the time when the transaction was physically posted

- Tax Return: the date the entry was on a committed VAT Return and only applicable for items with a tax element

- User: the name of the user who created the journal

- ActPeriod: not yet applicable, for future use.

- Edit Date: not yet applicable, for future use.

- Edit Time: not yet applicable, for future use.

- Edit User: not yet applicable, for future use.

Context Menu

- Apply Value Range: allows the user to specify a value that is to be applied to all of the currently selected rows/items for the current column.

- Clear Selection: deselects the currently selected line(s).