How To: Post a Purchase Invoice for an EU Consignment worth more than £135

This How To explains how to post a purchase invoice from an EU supplier when

the whole consignment value is worth more than £135.

Notes:

- Import VAT will be posted as Postponed Vat Accounting (PVA) which is similar to reverse charge but appears on the UK VAT Return.

- If you're not dealing with Import VAT, then this is treated as a UK VAT item, taxable / non-taxable based on user input.

Before this can be done, you must have created the purchase invoice, see How

To: Create a Purchase Invoice.

- Open a Purchase Invoice screen.

- Use the filters to find the required invoice.

- Double-click on the invoice to open it.

- Press Alt+E

or click

to enter edit mode.

to enter edit mode. - Enter the 'Supplier's Reference' in the Invoice Ref field (Optional).

Note: if there is an existing Purchase Invoice with the same Invoice Ref for the same supplier then a dialog will be displayed asking if the user wishes to continue as this would indicate that a duplicate Purchase Invoice has been created. - Amend the 'Invoice Date' where appropriate.

- Enter the delivery amount in the Delivery field (Optional).

- Make sure that the Less than £135 checkbox is not ticked.

- Check the 'Qty', 'Unit Price' and 'Tax' fields match the invoice from the supplier, amend as required.

- Check the 'Invoice Total' matches the paperwork sent by the supplier.

- To check that the Tax information is correct (the values will change

according to the values on your invoice) (Optional):

- Click on the

button. A series of popups will appear:

button. A series of popups will appear:

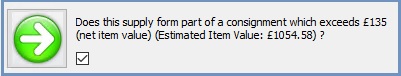

- Click OK on the message, leaving the checkbox ticked:

- Click OK on the message, leaving the checkbox ticked:

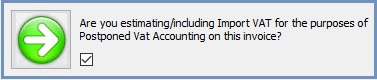

- Click OK on the message, leaving the checkbox unticked:

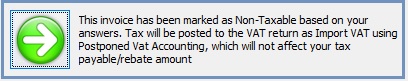

Note: if this is ticked and the previous answers are the default (ticked then ticked), then you will need to speak to your supplier as you will not be able to match the invoice as they should not be showing the VAT on their invoice based on your answers. - Click OK on the message which informs you that the invoice has been

marked as non-taxable and will be posted as Postponed VAT Accounting (PVA)

in the VAT Return:

- Click OK on the message, leaving the checkbox ticked:

- Click on the

- When the total is correct, tick the 'Post Invoice'

checkbox.

Note: if the total in the 'Import VAT' box is not correct, before posting the Purchase Invoice untick the 'Import VAT Calc' checkbox and amend the total. If you do not want to post any import VAT, then overtype the total with '0'. - Press Ctrl+S

or click

to save the invoice.

to save the invoice. - If the currency of the supplier is not in base currency, add the conversion rate to be used if required and click OK.

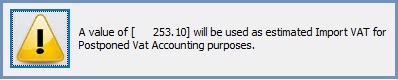

- In the next dialog informing you of the amount of Postponed VAT

Accounting, click on the yellow triangle and then click OK:

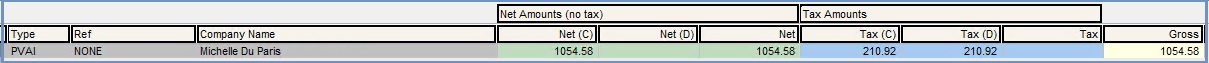

The resulting VAT return will have the entry in the upper UK grid as follows

with the PVA entry VAT, note that the entry has a Type of PVAI: