Accounting Periods

What is the Accounting Periods Dialog?

The Accounting Periods dialog allows the user to close down accounting periods, monthly, four-weekly or quarterly, preventing any transactions being posted and giving the accounts department tighter control over their accounts.

What are Benefits of Using the Accounting Periods Dialog?

- Closing down accounting periods prevents postings into specific time periods and is useful when the accounts department is happy with the status of the account and do not want any further transactions to occur.

- As the accounts in the accounting periods are checked and then closed the end of year annual clear down will be easier and quicker to perform.

- Accounting periods can be closed off for different areas of the system independently:

- Sales: stop sales invoices being issued into the closed date range.

- Purchases: stops purchase invoices being posted.

- Nominals: stops ALL financial transactions as they affect the nominals.

- Bank: stops payments, both sales and purchases that affect the bank accounts.

- A closed period can be 're-opened' if a posting needs to be made in a closed accounting period. It can then be closed again afterwards, but the accounting department has control on the posting that has occurred, see re-opening a closed period below.

How to Access the Accounting Periods Dialog

- Open an Accounts screen.

- Press F9 or clicking the down arrow immediately to the right of the

to open the 'Other Actions' menu.

to open the 'Other Actions' menu. - Press 1 or select Accounting Periods...'.

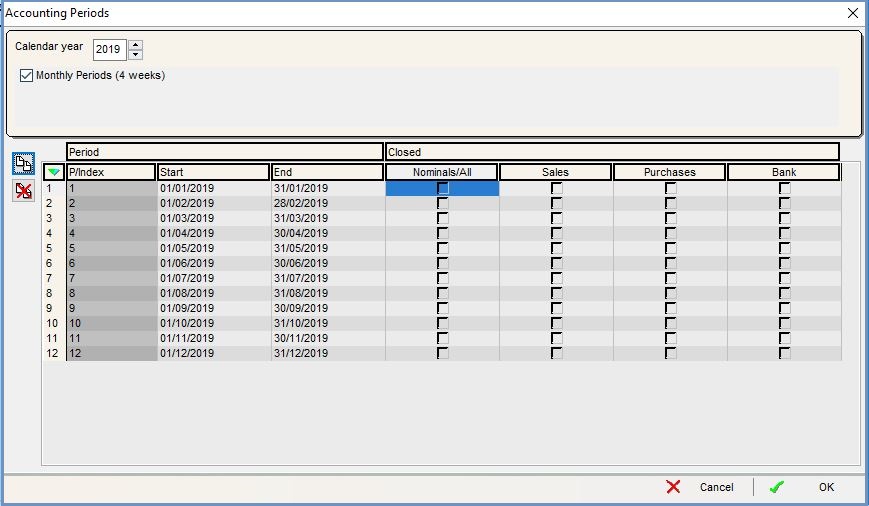

Accounting Periods Dialog

The Accounting Periods dialog consists of the maintenance and setup options and a grid:

Filter and Setup Options

- Year: select the year in which to add or view the periods.

- Monthly Periods (or 4 weekly) checkbox: used when creating the periods that can be monthly (ticked), four weekly (unticked) or quarterly. The image above shows monthly periods.

-

: add a new period in the year selected.

: add a new period in the year selected. -

: delete the period currently focused on or a group of green-selected periods.

: delete the period currently focused on or a group of green-selected periods.

Accounting Periods Grid

- Period: the number of the period in the current year.

- Start Date: the start date for the period.

- End Date: the end date of the period.

- Closed?: when the checkboxes are ticked the areas of the accounts to be closed and where no further postings can occur.

- Nominals/All: posting to any of the nominal accounts is prevented, in effect this prevents any transactions being posted in the system.

- This is often the last nominal to be closed.

- Sales: sales orders can't be saved or issued in the Sales Invoice Manager in closed periods.

- This is often the first nominal to be closed

- Purchase: although purchase orders can be created and the goods delivered in, posting a Purchase Invoice is prevented.

- This is often the second nominal to be closed.

- Bank: any posting to the bank accounts is prevented in a closed period.

- This is often the third nominal to be closed.

Accounting Periods Context Menu

- Apply Value Range: allows the user to specify a value that is to be applied to all of the currently selected rows/items for the current column.

- Clear Selection: deselects the currently selected line(s).

Setting up Accounting Periods

Monthly Accounting Periods

- Open any of the

[ Accounts ]screens. - Press F9 or clicking the down arrow immediately to the right of the

to open the 'Other Actions' menu.

to open the 'Other Actions' menu. - Select Accounting Periods.

- In the Accounting Periods dialog:

- Select the year that you wish to create the accounting periods for, for example 2013.

- Make sure the Monthly Periods checkbox is ticked.

- Click on the

button to add a new line to the grid repeating for each monthly period required (see image above).

button to add a new line to the grid repeating for each monthly period required (see image above).

Note: lines can be deleted by selecting them and clicking on the button.

button.

- Once the required accounting periods have been added, click on OK to close the dialog.

Four Weekly Accounting Periods

- Open any of the

[ Accounts ]screens. - Press F9 or clicking the down arrow immediately to the right of the

to open the 'Other Actions' menu.

to open the 'Other Actions' menu. - Select Accounting Periods.

- In the Accounting Periods dialog:

- Select the year that you wish to create the accounting periods for, for example 2013.

- Untick the Monthly Periods checkbox.

- Click on the

button to add a new line to the grid repeating for each four-weekly period required.

button to add a new line to the grid repeating for each four-weekly period required.

- Once the required accounting periods have been added, click on OK to close the dialog.

Using Accounting Periods

Closing Down Periods

- Open an Accounts screen.

- Press F9 or clicking the down arrow immediately to the right of the

to open the 'Other Actions' menu.

to open the 'Other Actions' menu. - Select Accounting Periods from the Other Actions menu.

- In the Accounting Periods dialog tick the appropriate Closed? Checkboxes to select the the accounts in the periods which should be closed:

- Nominals/All

- Sales

- Purchase

- Bank

- Once the required accounting periods have been closed click on OK to close the dialog.

Re-opening a Closed Period

Sometimes an accounting period needs to be re-opened, a transaction posted and the period closed again.

- Open any of the

[ Accounts ]screens. - Press F9 or clicking the down arrow immediately to the right of the

to open the 'Other Actions' menu.

to open the 'Other Actions' menu. - Select Accounting Periods.

- In the Accounting Periods dialog un-tick the checkbox for the area and period that you wish to re-open.

- Click on OK to close the dialog .

- Close and re-open the accounts screens before making any changes that will be affected by your changes.

- Once the changes have been made remember to close the period.

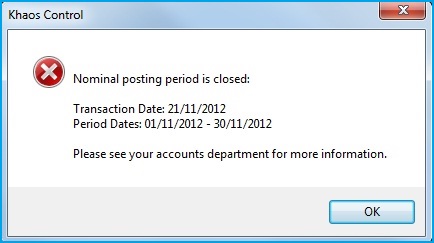

Trying to Post in a Closed Period

When trying to save an entry in the SP Ledger for a closed period the following message will appear:

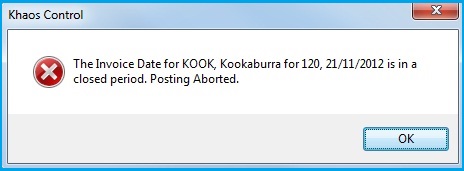

This message is similar to the message when trying to post in closed periods in other areas of the system. In the SP Ledger another message will appear:

The SP Ledger entry can't be saved and the user must cancel editing. They will need to close the accounts screens and re-open the accounting period/s before attempting to enter the SP Ledger entry again.

Currencies and Closed Periods

When you allocate an foreign currency item and loss/gain is determined, it can attempt to alter the closed period balance. It does a Max of the two transaction dates (invoice and payment) and posts the nominal journal on the most recent date.

- If they are both in closed periods, it will try to post it to a closed period.

- If one is open one is closed, (assuming the newest one is open) by virtue of how it selects the date to use it will post into the open period.

- If the older one is open (I wouldn't think this is logical) and the new one is closed (??) then you will get an error the same as you would in scenario (a).