Making Tax Digital - Connecting to HMRC

Contents

- WARNING: The screenshots and process detailed below is taken from testing data and may change once the functionality goes live

| |

|

|---|

Enabling MTD

Before using MTD you will need to configure the system to use MTD. To do this:

- Open

[ System Operations | Edit System Values | Accounts - General ]. - Select the option Digitally from the HMRC Tax Submission drop-down.

- Click OK.

- Close and restart Khaos Control.

The MTD Process

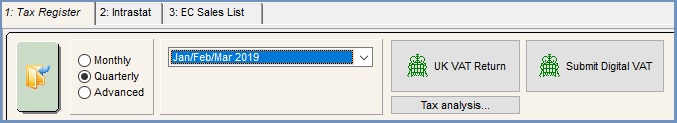

The [ Accounts | Tax (VAT) | Tax Register ] screen has two new buttons next to the existing UK VAT Return button:

These buttons are used to connect to HMRC and then submit your VAT Return, see submitting a VAT Return.

MTD Video of the process

Prepare your VAT Return

- Open an Accounts screen.

- Open the

[ Accounts | Tax (VAT) | Tax Register ]screen. - Filter for the VAT data you wish to submit to HMRC.

- You can view the data using the

button.

button.

Get the Authentication Code to grant access to interact with HMRC

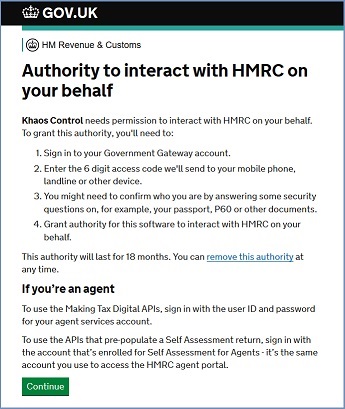

- WARNING: Do not use the Self-Assessment option shown in the lower half of the image at step 4. If in doubt please contact your accountant

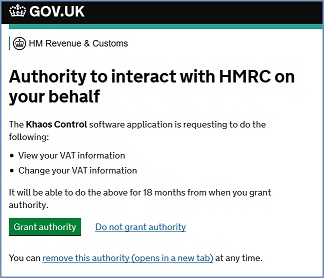

The authentication code lasts for 18 months and enables Khaos Control to interact with HMRC on your behalf:

- Click on the

button. This will initiate communication with HMRC.

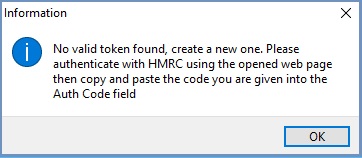

button. This will initiate communication with HMRC. - A popup will appear informing you that there is no current token and asking if you would like to create one, click on Yes.

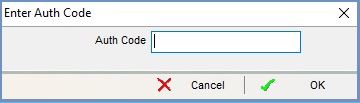

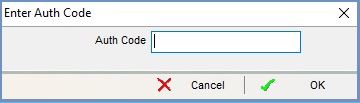

- The Auth Code prompt will appear:

- Click on the Continue button on the bottom of the HMRC webpage:

Remember do not use the Self Assessment option.

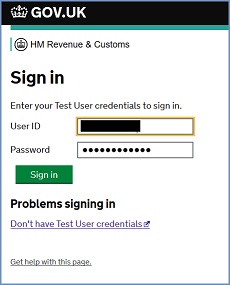

- Sign in with your details:

- Click on the Grant Authority button in the next screen:

- Copy the authentication code:

- Paste the code into the Auth Code prompt and click OK:

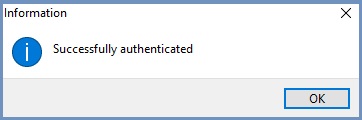

- Click OK in the Information dialog:

- You will now be taken to the Obligations pop-up which will include data retrieved directly from HMRC for your business, Processing a VAT Return

Notes:

- You can check to see the current state of your connection tokens in

[ System Data | Others | OAuth Tokens ]. - The Submit button will be grayed out until an authentication code has been entered.

- For common error messages, see Making Tax Digital - A Guide to Error Messages.