018897: UK Vat EU sales figures Box 6 and Box 8

Overview

Changes to the EU VAT returns have been added specifically for those using Country Specific VAT.

Specification

Modifications have been made to ensure Country VAT recorded sales are included in the EU figures making up Box 6 and Box 8 on the UK VAT Return.

Notes:

- These figures do not affect the VAT payable figures (box 5) at all; only the statistical figures reported to HMRC about EU Sales.

- These changes are not retrospective and will only apply to newly posted transactions.

- As of 8.188 onwards the reference / customer information for transactions covered by this development will show the customer information rather than blank.

- As of 8.189 onwards, customers can opt out of this information being recorded using the option Country VAT EC Sales Excluded in

[ System Values | Accounts | General ]. This option will disable this development for all *new* transactions only, any previously generated transactions will still be recorded and reported upon. The changes for the development were made upon the advice of HMRC and only affect the "sales" figures reported to HMRC , they do not affect the values being paid / credit to HMRC in UK Tax.

Configuration

No configuration is required, beyond applying the update.

Usage

Steps for usage include:

- Create a Sales Order for an EU customer.

- Add an item that incurs EU VAT, see How To: Setup Country Specific VAT for more information.

- Process the Sales Order and Issue it in the Sales Invoice Manager.

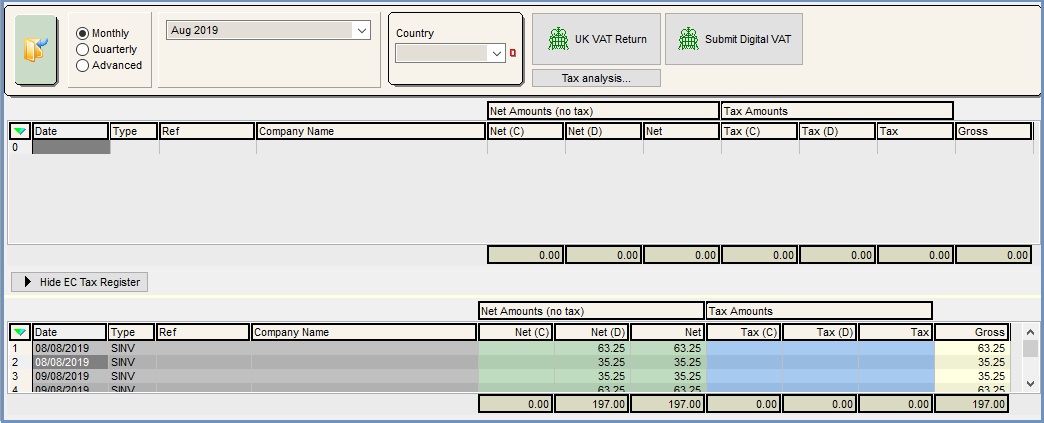

- Open the

[ Accounts | Tax (VAT) | Tax Register ].- When reporting on Country UK (None in the dropdown), the entries now appear in the EC Tax Register (as Net values)

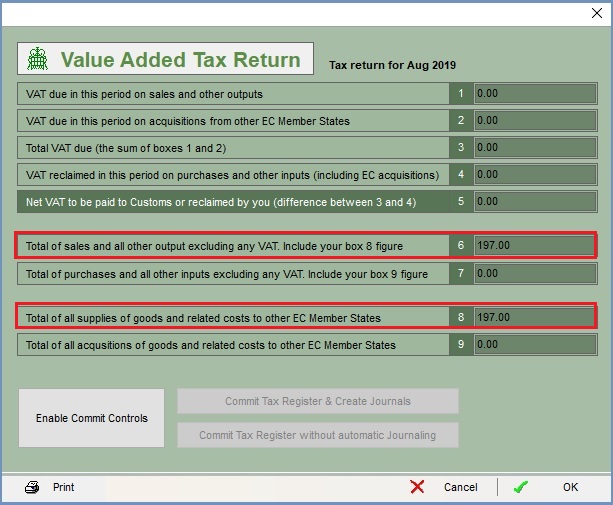

- The total Net Amount can be reported to HMRC from the UK VAT Return dialog. This is shown in Box 6: 'Total of sales and other output excluding any VAT' and Box 8: 'Total of all supplies of goods and related costs to other EC Member States:

- When reporting on Country UK (None in the dropdown), the entries now appear in the EC Tax Register (as Net values)

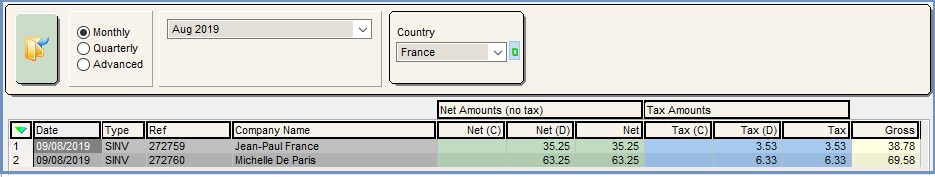

- If filtering on a specific country the system will show the individual entries which can then be committed using the right-click menu option Commit Tax Return.

SQL Report

This new behaviour can be confirmed by changing the date on this following SQL query:

select * from ledger_taxregister where date_entered > '01-AUG-2019'

New EU Sales Invoices will have two entries in this table. One non EC and one EC. The EC entry has 'EC-' prefixed to the ledger_id and EC_transaction is True (-1).