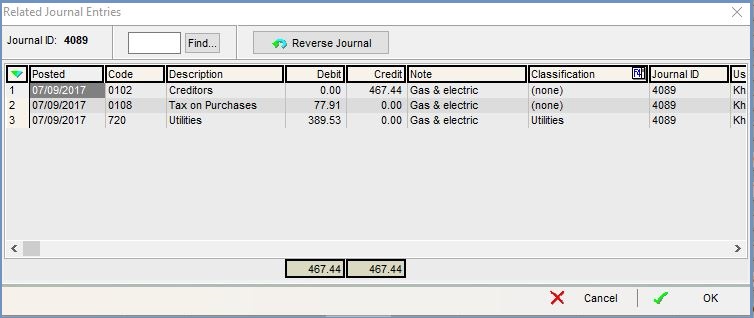

Related Journal Entries Dialog

The Related Journal Entries dialog displays the double-entry information for the selected entry. It is available in the following screens:

- The

button in the

button in the [ Purchasing Invoice ]screen. - The context menu option 'Show Journal Details' in the Statement Transactions grid in the

[ Customer / Supplier | Statement ]screen. - The context menu option 'Show Journal Pop-up' in the following screens:

- The

[ Accounts | Bank Accounts ]screen. - The

[ Accounts | Tax (VAT) | Tax Register ]screen, upper grid. - The Transaction Details grid in the

[ Accounts | Nominal Accounts ]screen. - The

[ Accounts | SP Ledger ]screen.

- The

The Related Journal Entries dialog contains two areas; the search area at the top and the grid.

Note: the top area is not in the dialog when opened from the [ Customer / Supplier | Statement ] and the [ Accounts | Tax (VAT) | Tax Register ] screens.

Related Journal Entries Action Buttons

- Journal ID: the journal ID number for the current journal information.

: allows the user to search for a journal by entering the number in the adjacent field and pressing this button.

: allows the user to search for a journal by entering the number in the adjacent field and pressing this button.-

button.: creates a new journal to reverse the journal in the grid. As part of the process you can define the date that you want the journal to be reversed on. The system will inform you which two journal IDs have been affected.

button.: creates a new journal to reverse the journal in the grid. As part of the process you can define the date that you want the journal to be reversed on. The system will inform you which two journal IDs have been affected.

Related Journal Entries Grid

- Posted: the date the journal was posted.

- Code: the nominal code.

- Description: the name of the nominal account.

- Debit: the credit amount.

- Credit: the debit amount.

- Note: any note written against the journal either manually or by the system, for example when creating an entry in the

[ Accounts | Nominal Accounts ]screen. - Classification: the nominal classification if set.

- JournalID: the journal ID number for the current journal entry.

- User: the user if the journal was created manually for example in the

[ Accounts | Nominal Accounts ]screen or as the result of a stock Adjustment. - Post Date: the date the entry was posted to the accounts.

- Post Time: the time the entry was posted to the accounts.

- Tax Committed: the date that the entry was committed on the Tax Return.

- Reverse Date: if a journal has been reversed this will show the date it was reversed.

- Reverse Time: if a journal has been reversed this will show the time it was reversed.

- Reverse Journal ID: the ID of the (new) reversed journal.

- Audit Note: this will show Manual Reversal if the entry has been reversed.