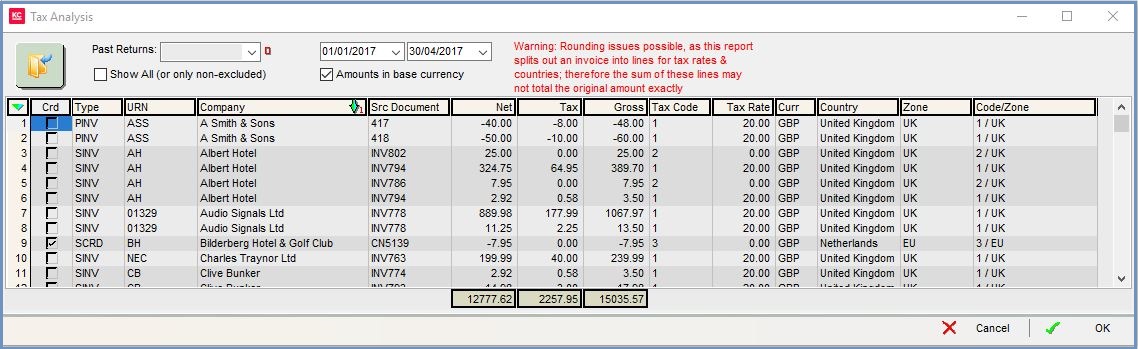

Tax Analysis Dialog

The Tax Analysis dialog allows users to view past returns. The data contained is the same as that found in the Tax Register grid; however, it is broken down by Country, Zone and Tax Code to give a more detailed tax analysis. The information in the grid can be printed using Print Grid or exported using Send to Notepad. The Tax Analysis dialog is accessed by pressing the ![]() button in the

button in the [ Accounts | Tax (VAT) | Tax Register ] screen.

The popup consists of the top filters and the grid.

Tax Analysis Filters

- Go button: populates the grid according to the filters set.

- Past Returns dropdown (

/

/ traffic light filter): filter by the past returns as listed in the dropdown. If a past VAT return is selected and the traffic light is on (green) then the range date field is ignored

traffic light filter): filter by the past returns as listed in the dropdown. If a past VAT return is selected and the traffic light is on (green) then the range date field is ignored - Show All (or only non-excluded) checkbox: shows all the items in the grid or only shows those that have been marked as excluded in the

[ Accounts | Tax (VAT) | Tax Register ]screen. - Date Range: filter the information in the grid between the dates selected.

- Amounts in base currency (default=ticked): show the monetary amounts in the grid in the base currency, for example sterling, or else the currency the entries were made in.

Tax Analysis Grid

- Crd checkbox: indicates whether the entry is a credit or not.

- Type: for example PINV (Purchase Invoice) or SINV (Sales Invoice).

- URN: of the customer or supplier the entry relates to.

- Company: the name of the customer or supplier the entry relates to.

- Src Document: the sales invoice number or purchase invoice number.

- Net: the net amount.

- Tax: the amount of tax.

- Gross: the gross amount.

- Tax Code: the tax code indicating the tax rate as listed in the Code column in

[ System Data | Accounts | Tax Rates ]screen. - Tax Rate: the tax rate as listed in the Code column in

[ System Data | Accounts | Tax Rates ]screen. - Curr: the currency of the entry, this will be in base currency unless the Amounts in base currency checkbox is un-ticked.

- Country: the name of the country of the customer or supplier.

- Zone: the zone of the customer or supplier's country as set up in

[ System Data | International | Countries ]. - Code/Zone: the Tax Code and Zone.