How To: Reprocess an Order to use a different VAT Rate

Scenario

An order has been raised that includes VAT, but the person actually paying for the order (i.e. not necessarily the one ordering the items) has proved to your satisfaction that the goods/services you have supplied are to be charged at a different rate of VAT (these reduced or exempt rates may only apply if certain conditions are met, or in particular circumstances, as detailed on HM Revenue & Customs website).

- WARNING: DISCLAIMER: Khaos Control Solutions Ltd are not accountants.

You should seek advice from your own professional advisor and/or HM Customs & Excise before reprocessing orders to use non-standard VAT rates

Prerequisites

Setup - Return Reasons

In [ System Data | Sales Order Processing | Return Reasons ] create a new Return Reason of (for example) Customer pays non-standard VAT rate with a Processing Type of "Stock Missing" (or another processing type that does not affect stock movements).

- Note: This code may already exist on your system with the 'Hide' checkbox ticked, meaning that it is not displayed as a current choice. Simply untick this checkbox and the reason will be displayed (you may need to close and re-open the affected screen to see the new reason).

Setup - Miscellaneous Stock Items

It is assumed that all applicable VAT rates have already been created in System Data.

The following stock items should be created, if they do not already exist on your system:

| Stock Code | Stock Description | Stock Type | Base Tax Rate |

|---|---|---|---|

| SYS_MISC_EX | MISC (EXEMPT VAT) | System & Miscellaneous | Exempt |

| SYS_MISC_RED | MISC (REDUCED VAT) | System & Miscellaneous | Reduced |

| SYS_MISC_STD | MISC (STANDARD VAT) | System & Miscellaneous | Standard |

| SYS_MISC_Z | MISC (ZERO VAT) | System & Miscellaneous | Zero |

- Note: Where you supply goods or services at other VAT Rates, an additional MISC stock item should be created for each VAT Rate.

All of the above should have stock options set as follows:

| Stock Option | Setting |

|---|---|

| Stock Controlled | NOT ticked |

| Free Text Descriptions | Ticked |

| Automatic Quality Check | Ticked |

| Discounts Disabled | Ticked |

| Hide Item on Price Lists | Ticked |

| Non-physical item | Ticked |

| Exclude delivery labels | Ticked |

Reprocessing the Sales Order

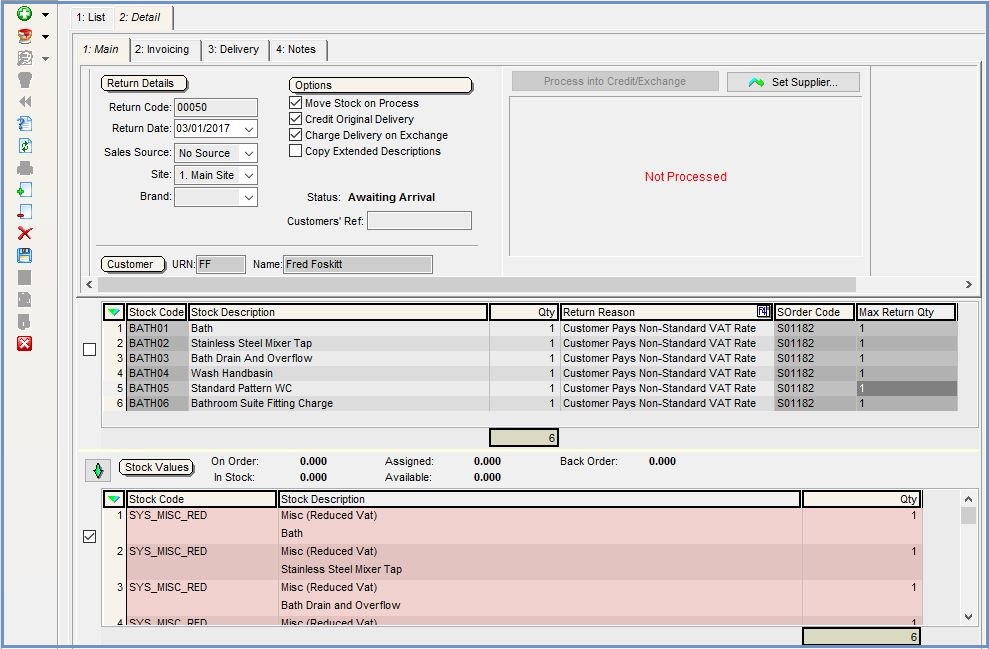

- Open the Sales Order and create a Return for the entire order INC VAT by green selecting ALL the items in the grid and clicking on the Returns button.

- In the Return set the Return Reason to Customer pays non-standard VAT rate.

- Add the appropriate miscellaneous stock item(s) to the lower grid (you may wish to copy the descriptions from the original stock items to the miscellaneous stock item's Extended Description field).

- Tick the "Credit Original Delivery" checkbox.

- Tick the "Charge Delivery on Exchange" checkbox.

- Press Ctrl+S or click

to save the Return. The screen should then look something like this:

to save the Return. The screen should then look something like this:

- Click on

button.

button. - Issue the Credit Note to the value of original order INC VAT.

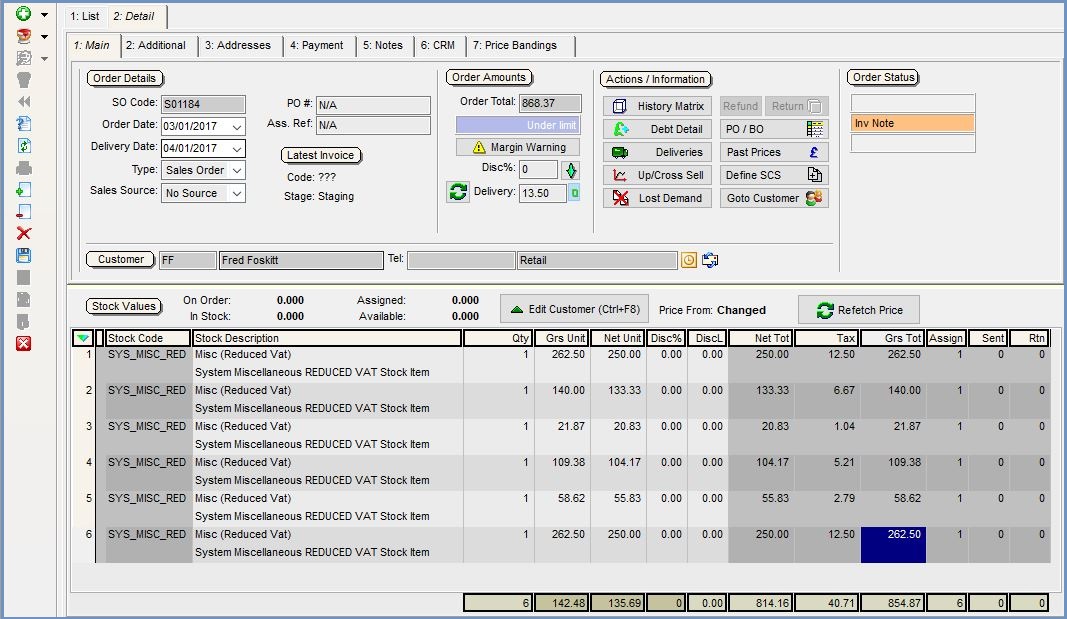

- Click on the "Goto the Exchange Note" button and edit the Exchange Order to:

- Add the original net price to each item; and

- Copy the descriptions from the original stock items to each item.

- Press Ctrl+S or click

to save the Returns Exchange Sales Order, overriding the "prices have changed" warning and entering some suitable text when prompted for the reason for editing the exchange order. The screen should then look something like this:

to save the Returns Exchange Sales Order, overriding the "prices have changed" warning and entering some suitable text when prompted for the reason for editing the exchange order. The screen should then look something like this:

- Go back to the Return and click on the Credit button for the Exchange Note. This will create a refund amount to be used against the Returns Exchange Sales Order.

- The balance can be either be:

- Issued to the customer's statement using the Issue button or

- Refunded to the customer using their original payment type using the Refund/Issue button.