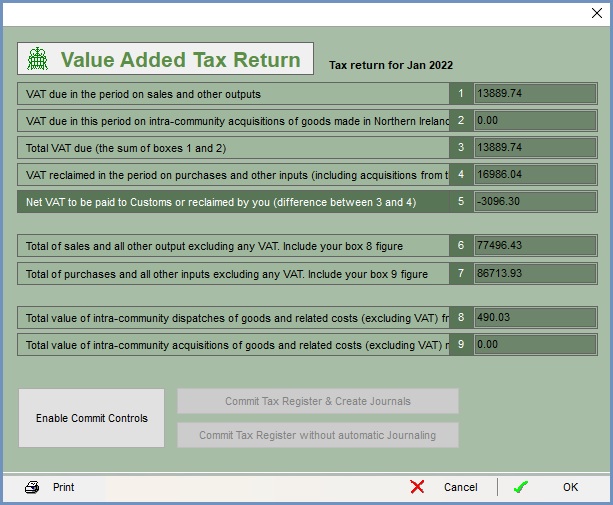

Value Added Tax Return

The Value Added Tax Return screen is accessed by clicking on the  button in the

button in the [ Accounts | Detail | Tax (VAT) | Tax Register ] screen. For processing a VAT Return see How To: Process a VAT return.

The screen details the information that will be contained in the tax return and that was listed in the grid in the [ Accounts | Detail | Tax (VAT) | Tax Register ] screen.

Tax Return

- 1 VAT due in this period on sales and other outputs: taken from the Tax Amounts - Tax (D) column.

- 2 VAT due in this period on intra-community acquisitions of goods made in Northern Ireland from EU Member States: taken from the Tax Amounts - Tax (C) column in the EC Tax Register.

- 3 Total VAT due (the sum of the boxes 1 and 2): the sum of 1 and 2.

- 4 VAT reclaimed in this period on purchases and other inputs including acquisitions from the EU: taken from the Tax Amounts Tax (C) column plus the Tax Amounts Tax (C) column in the EC Tax Register.

- 5 Net VAT to be paid to Customs or reclaimed by you (difference between 3 and 4): the difference between 3 and 4.

- 2 VAT due in this period on intra-community acquisitions of goods made in Northern Ireland from EU Member States: taken from the Tax Amounts - Tax (C) column in the EC Tax Register.

- 1 VAT due in this period on sales and other outputs: taken from the Tax Amounts - Tax (D) column.

- 6 Total of sales and all other outputs excluding any VAT. Include your box 8 figure: taken from the Net Amounts (no tax) Net (D) column and the Net Amounts (no tax) Net (D) column in the EC Tax Register and includes any figure in box 8.

- 7 Total purchases and also all other inputs excluding any VAT. Include your box 9 figure: taken from the Net Amounts (no tax) Net (C) column and the Net Amounts (no tax) Net (C) column in the EC Tax Register and also includes any figure in box 9.

- 7 Total purchases and also all other inputs excluding any VAT. Include your box 9 figure: taken from the Net Amounts (no tax) Net (C) column and the Net Amounts (no tax) Net (C) column in the EC Tax Register and also includes any figure in box 9.

- 6 Total of sales and all other outputs excluding any VAT. Include your box 8 figure: taken from the Net Amounts (no tax) Net (D) column and the Net Amounts (no tax) Net (D) column in the EC Tax Register and includes any figure in box 8.

- 8 Total value of intra-community dispatches of goods and related costs (excluding VAT) from Northern Ireland to EU Member States: when trading from Northern Ireland.

- 9 Total value of intra-community acquisitions of goods and related costs (excluding VAT) made in Northern Ireland from EU Member States: when trading from Northern Ireland.

- 8 Total value of intra-community dispatches of goods and related costs (excluding VAT) from Northern Ireland to EU Member States: when trading from Northern Ireland.

VAT return

-

: enables the following two buttons:

: enables the following two buttons:-

: will mark all the transactions that have just been reported on as being committed so that they do not show as valid transactions for future VAT returns and also does two automatic journals; the first one between "Tax on Sales", "Tax on Purchase" & "Tax Paid (VAT Control)"; and the second between "Tax Paid (VAT Control)" & the Bank Control account for the selected bank in the drop-down list.

: will mark all the transactions that have just been reported on as being committed so that they do not show as valid transactions for future VAT returns and also does two automatic journals; the first one between "Tax on Sales", "Tax on Purchase" & "Tax Paid (VAT Control)"; and the second between "Tax Paid (VAT Control)" & the Bank Control account for the selected bank in the drop-down list. -

: will mark all the transactions that have just been reported on as being committed so that they do not show as valid transactions for future VAT returns.

: will mark all the transactions that have just been reported on as being committed so that they do not show as valid transactions for future VAT returns.

-