How To: Claim back Import Tax when using Country VAT

The following describes the process required to claim back import tax for a non-UK Company when using Country Specific VAT.

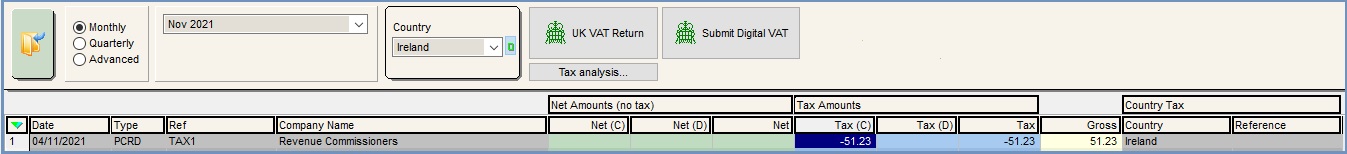

The credit will appear in the [ Accounts | Tax (VAT) | Tax Register ] screen when filtering for the country the entry is for.

Prerequisites

- A supplier, for example the Revenue Commissioners for Ireland, with the following options enabled in the

- Supplier: ticked

- EC company: ticked

- Company pays tax: ticked

- You must be using Country Specific VAT with the different Tax rates setup, see How To: Setup Country Specific VAT.

Adding the SPLedger Entry

- Open an Accounts screen.

- Open the

[ SP Ledger ]tab. - Press Alt+E or click

to enter edit mode.

to enter edit mode. - Press F3 or click

to add a new item.

to add a new item. - Use the Lookup dialog box to locate the supplier (for example the Irish Revenue Commissioners) that you wish to post the credit for. A new row is added to the grid for the selected supplier.

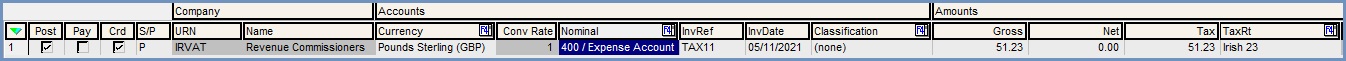

- The following SP Ledger options must be set:

- Post: if this checkbox is:

- TICKED (default): If you have already received the Supplier Credit note.

- UNTICKED: If you have not yet received the supplier credit note and allows the transaction to be posted later.

- Pay: this option must not be ticked.

- Crd: must be TICKED as this will mark the SP Ledger entry as a Supplier Credit.

- S/P: must be set to P to indicate a Purchase ledger entry.

- Conversion Rate: change the conversion rate if required (Optional).

- Nominal: nominal account, however no entries are made to this nominal when this journal is posted.

- InvRef: the supplier's invoice reference.

- InvDate: the date of the invoice.

Note: if the invoice date is today's date then a warning message will appear. - TaxRt: should be the rate for the specific country the entry is for.

- Tax: enter the amount you are claiming back.

- Description: used to describe what the invoice was for (Optional).

- Status Note: can be used to track invoices that require approval from various departments prior to posting (Optional).

- Post: if this checkbox is:

- Press Ctrl+S or click

to save the transaction.

to save the transaction.

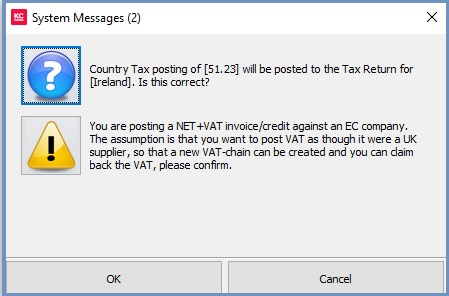

- Check the information and acknowledge by clicking on the blue circle or yellow warning buttons.

- If the credit for today's date, acknowledge the warning message.

- Click on OK in the Information popup.

- Click on OK to the Information popup showing the SPLedger number.

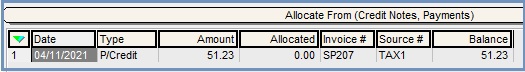

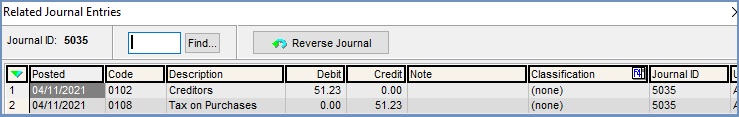

The following postings are made:

Note: As when using Country Specific Tax and committing your tax register, the tax in the Tax on Purchases nominal will need to be cleared down.