Intrastat Report

Contents

Intrastat reports can be automatically generated by Khaos Control. Intrastat reports are a requirement of the Inland Revenue for any company importing or exporting goods with a value above a certain threshold to the EU each year. The amount changes from year to year so please check with the Inland Revenue to see whether your business is required to submit reports or not, see HMRC Intrastat.

The Intrastat report is used to report what type of goods, and how many of them, you are sending to each EU country. In order for the report to generate valid information and so that system can classify them correctly on the report the following must be set up on the system:

- Customers must be set up with the correct country in their customer record

[ Customer | Detail | Financial ]screen. - Stock items must be set up with the correct Intrastat Commodity Code/Number (ICN) and unit, see How To: Setup Intrastat ICN Codes.

Intrastat Report

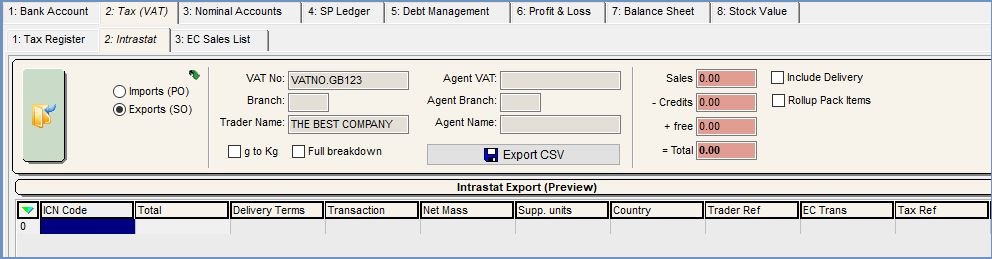

The Intrastat screen is a sub-tab of the Tax tab in [ Accounts | Tax (VAT) ].

The controls at the top of this screen control how the report is produced; these are:

- Go: Click the Go button to prepare the report once the filters are set.

- Imports (PO) or Exports (SO): whether to produce an Intrastat report for goods received (PO), or goods sent out to the EU (SO).

- Date From / To: the date range to report on. Since Intrastat is normally a monthly requirement, the system will warn you if the range you choose does not fall within one calendar month. You are free to report on any range but bear in mind this is not normally required by the Inland Revenue.

- VAT No, Branch, Trader Name: Your VAT number and Trader Name will be read from the details in System Values when the screen is first opened. Branch is a manually entered field but not necessarily required.

- Agent VAT, Branch, Name: if the Intrastat report is being prepared by an agent on behalf of the trading company, the agents' details can be entered here.

- G to KG: if your weights for stock items are measured in grams, you can tick this to convert the weights into KG, since Intrastat requires weights to be submitted in KG.

- Full Breakdown: this splits the display to provide full information per invoice rather than per commodity code. This is not the format you should submit the Intrastat report in " the function is provided so you can see how the figures are derived if there is any question about their accuracy or source.

- Export CSV: This exports a CSV file in the format specified by the Inland Revenue for electronic submission.

- Cost Information Area: Total broken down by Sales, Credits and free.

- Include Delivery Charge: When ticked, the delivery charge for each Sales Order (Net) is added proportionally to the totals for that order, based on the amounts per line.

Intrastat Grid

- ICN Code: the ICN Code as set up in

[ System Data | International | Intrastat ICN (or Intrastat ICN Stock Types) ]screens. - Total: the total of the order line for the item from the total displayed at the top right of the screen.

- Delivery: delivery terms field is editable on the Intrastat Grid that is produced. Before exporting the information to .csv file this field needs to be completed with the delivery code.

- Transaction: is used to indicate the type of transaction which is being declared for example sales or purchase orders.

- Net Mass: net mass in kilograms. This uses the Avg Weight as set against each stock item in the Stock Control/Other area of their

[ Stock | Detail | Properties ]screen.

Note: this is rounded up in this screen. - Supp Units: the supplied units as set up in as set up in

[ System Data | International | Intrastat ICN (or Intrastat ICN Stock Types) ]screens. - Country: the stock items are being imported from or exported to.

- Trader Ref: (Optional) the trader reference to be exported in the .csv file.

- URN: of the customer or supplier.

- Invoice: the Sales or Purchase Invoice number.

Note: the URN and Invoice columns are visible only when the Full Breakdown filter is active. - Supplier Ref: the supplier's Purchase Invoice Code (Supplier's Reference for the Invoice they have sent) as entered on the

[ Purchase Invoice ]screen.

Note: this will only be displayed when the following filters are ticked:- Full Breakdown

- Import(PO)

Note: the light grey columns are editable and will require completing before creating the .csv file.

Intrastat Grid Context Menu

- Goto Purchase Invoice: opens the Purchase Invoice for the selected entry.

- Goto Sales Invoice: opens the Sales Invoice for the selected entry.

- Apply Value Range: allows the user to specify a value that is to be applied to all of the currently selected rows/items for the current column.

- Clear Selection: deselects the currently selected line(s).

The Intrastat Figures

The Intrastat figures will not necessarily match the tax register as credits are not displayed as negative amounts on the Intrastat grid and report, however, the total value of credits are displayed in the Cost Information Area at the top right.