Accounts Tax (VAT) Intrastat Tab

For the Other Action Menu options (press F9 or ![]() ) see Accounts Other Actions Menu.

) see Accounts Other Actions Menu.

Intrastat reports are a requirement of the Inland Revenue for:

- Goods moving between Northern Ireland and the EU.

Note: You do not need to submit a declaration for goods you export from Great Britain to the EU.

This affects goods with a value above a certain threshold to the EU each year, see HMRC Intrastat Guide. The amount changes from year to year so please check with the Inland Revenue to see whether your business is required to submit reports, for a description of the screen see Intrastat Report. Khaos Control automatically generates Intrastat reports, see How To: Report on ICN Imports (PO) and Exports (SO) and for setting up Intrastat ICN Codes see How To: Setup Intrastat ICN Codes. The grid returns the figures for stock items and does not include delivery charges.

The screen consists of the upper options and the grid.

Intrastat Options

Main Filter Menu

- Go button: to populate the grid the Go button must be pressed.

- Imports (PO) radio button: report on imports (Purchase Orders).

- Exports (SO) radio button: report on exports (Sales Orders).

- VAT Number: the company VAT number automatically populated from

[ System Values | General | Your Company ]. - Branch: the name of the branch of your company submitting the ICN data.

- Trader Name: the company's trading name.

- g to Kg checkbox: update the amounts to Kg, if average weights have been recorded in grammes.

- Note: Whilst Khaos Control works with any numerical weight system that uses factors of 10, or any ratio of it (e.g. any metric system, such as grammes or kilogrammes), certain courier integrations may stipulate the unit to be used.

Once a unit of weight is chosen, it must be used consistently throughout the system (e.g. in Stock, Customer weight-related discounts, Courier Banding and Delivery Rates). Do not enter some weights in grammes and others in kilogrammes, otherwise errors will occur.

- Note: Whilst Khaos Control works with any numerical weight system that uses factors of 10, or any ratio of it (e.g. any metric system, such as grammes or kilogrammes), certain courier integrations may stipulate the unit to be used.

- Full Breakdown checkbox: displays additional columns and enables the Goto options in the context menu.

- Agent: if an agent, for example your accountant, is submitting your Intrastat report for you then you can enter their:

- Agent VAT: the agent's VAT number.

- Agent Branch: agent's branch.

- Agent Name: agent name.

button: creates a CSV file of the data in the grid.

button: creates a CSV file of the data in the grid.

- Breakdown Area:

- Sales: total value of sales or purchases.

- - Credits: minus the total value of any credits.

- + free: goods supplied free of charge for example commercial samples.

- Total: the total value of the items in the breakdown.

- Include Delivery: when ticked, the delivery charge for each Sales Order (Net) is added proportionally to the totals for that order, based upon the amounts. For example:

- A Sales Order includes two items, one for £100 against ICN 1 and the other for £200 against ICN 2, and a delivery charge of £3.

- ICN 1 will display as £100 + £1 = £101.

- ICN 2 will display as £200 + £2 = £202.

- Free items will have no delivery charge proportioned to them.

- Rollup Pack Items:

- Ticked: the pack childrens weight will be rolled up into the pack header, grouped by the ICN code.

Note: this is only available for the Export (SO) option. The checkbox is disabled when Export (PO) is enabled. - Unticked: the pack childrens weight will not be rolled up into the pack header and may result in accounting for the child items twice.

- Ticked: the pack childrens weight will be rolled up into the pack header, grouped by the ICN code.

- Rounding Active:

- Ticked: the system will round the Net Total in the grid to whole amounts.

- Unticked: the system will display the Net Total to two decimal places.

- Use Legacy Totals:

- Ticked: will use the current calculations.

- Unticked: will allow for Intrastat values to be calculated using ledger entries.

Filter Menu under

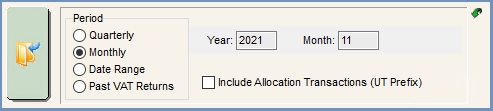

- Period:

- Quarterly: total value of sales or purchases.

- Year: (editable) The year the user wishes to query (defaults to current year).

- Quarter: dropdown menu with Q1 (Jan 01 - Mar 31), Q2 (Apr 01 - Jun 30), Q3 (Jul 01 - Sep 30), Q4 (Oct 01 - Dec 31) applicable to the selected year (see above).

- Monthly: total value of sales or purchases.

- Year: (editable) The year the user wishes to query (defaults to current year).

- Month: (editable) The month the user wishes to query (defaults to current month).

- Date Range: total value of sales or purchases.

- From and To: date range to report on.

Note: this should be a monthly range.

- From and To: date range to report on.

- Past VAT Return: total value of sales or purchases.

- Year: dropdown menu with all previous tax returns.

Note: Past returns are defined by the date they were committed on.

- Year: dropdown menu with all previous tax returns.

- Include Allocation Transactions (UT Prefix): checkbox: if payments have been marked as under/over paid or currency exchange differences then they are identified in the

[ Customer / Supplier | Detail | Statement ]grids with the Invoice prefix UT.

- Quarterly: total value of sales or purchases.

Intrastat Grid

- ICN Code: the ICN Code as set up in

[ System Data | International | Intrastat ICN ]screen as defined against the stock item. - Total: net value of the goods being sent.

Note: this is rounded to the nearest pound. - Delivery Terms: delivery charges.

- Transaction: the Transaction Code, for example :

- 10 - Sales Invoice

- 16 - Credit Note

- 30 - Free Items

For a list see the HMRC Intrastat Guide

- Net Mass: net mass in kilograms. This uses the Avg Weight as set against each stock item in the Stock Control/Other area of their

[ Stock | Detail | Properties ]screen.

Note: this is rounded up in this screen. - Supp Units: Supplementary Units as set up against each stock item in the Sup Unit Value field in the Commodity Codes - Intrastat & Customs ROW area in their

[ Stock | Detail | Accounting ]screen.

Note: either the Net Mass or Supplementary Units are required to be completed which commodity code. - Country: the country listed against the supplier or customer.

- Trader Ref (Optional): possibly an invoice number.

- EC Trans: indicates if this is an EC transaction -1 equals to yes.

- Tax Ref: the Tax Ref from the customer or supplier's

[ Customer | Detail | General ]screen. This is not retrospective, so ensure that all the Tax Ref is on the company record.

The following columns are visible when the Full Breakdown checkbox is ticked:

- URN: the customer or supplier's URN.

- Invoice: the sales or purchase invoice number.

- Supplier Ref (only if Imports (PO) radio button selected): the Invoice Ref listed against the

[ Purchase Invoice ].

Intrastat Grid Context Menu

- Goto Purchase Invoice: opens the corresponding purchase invoice for the line currently focused in.

- Goto Sales Invoice: opens the Sales Invoice Manager focusing on the invoice for the line currently focused in.

Note: the two above options are only enabled once the Full Breakdown checkbox is ticked. - Apply Value Range: allows the user to specify a value that is to be applied to all of the currently selected rows/items for the current column.

- Clear Selection: deselects the currently selected line(s).