ICAEW Accounts Changes

Contents

- 1 Summary of Accounts facility changes in Khaos Control

- 2 8.116 onwards

- 3 8.131 onwards

- 4 8.132 onwards

- 5 8.133 onwards

- 5.1 [013285] Modify Foreign Exchange Base Loss/Gain posting date algorithm

- 5.2 [016083] Make the Include Credits options a System Value Option

- 5.3 [016303] Improve Multi-currency support on Debtors Detail Report

- 5.4 [015926] Prevent users from Editing or Deleting Journals.

- 5.5 [016267] Intrastat / Country VAT support for Monaco

- 5.6 [016084] Purchase Invoice Settlement Discount Post Date modifications

- 6 8.135 onwards

- 7 Appendix

- 8 See Also

Summary of Accounts facility changes in Khaos Control

We are ICAEW accreditation for Khaos Control having updated varios areas of the system to meet with the requirements. Below is a list of changes which have been undertaken to update the system.

8.116 onwards

[011409] Better sequence handling

The root table responsible for nominal transactions (and a few other key areas) has been upgraded so that the posting date and User ID are encoded into the data.

BENEFIT: This will allow for auditing and tracking of when accounting transactions are posted for comparison against the accounting date.

8.131 onwards

[015928] Customer/Supplier Statement - display conversion rate

Customer and Supplier statement grid now has extra information when viewing Base Currency relating to conversion rates. These can be enabled/disabled via the grid menu Grid Configuration option.

BENEFIT: Provides users with detailed data, direct from the ledger entries, when drilling into foreign currency transactions on customer and supplier statements.

[015535]: Nominal Accounts Budgets

We have enabled our Nominal Accounts budgets feature for the Profit and Loss screen. It can be activated through the [ System Values | Accounts ] section.

If you would like more information about the use of this feature, please email Training.

8.132 onwards

Bank Reconciliation process improvements

We have made the following changes:

- The Start/End process has been modified to become a single Commit process.

- The ability to accept an imbalanced Bank Reconciliation total has been removed to avoid errors being introduced.

For more information see, How To: Perform a Bank Account Reconciliation.

BENEFITS:

- Committing the reconciliation in a single process, removes the potential for partial reconciliations to be committed in error.

- It is no longer possible for imbalanced bank reconciliations to be posted, further removing the opportunity for errors to be introduced.

8.133 onwards

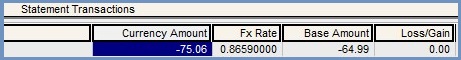

[013285] Modify Foreign Exchange Base Loss/Gain posting date algorithm

Loss/Gains use a modified algorithm to determine the accounts date to use. Before the change old payments and invoices from the last financial year that you now wish to allocate in the current financial year, the system will use today's date to allocate payment to invoice.

BENEFIT: The accounts date used by Khaos Control when posting Loss / Gain transactions for foreign currency postings is now more accurate.

[016083] Make the Include Credits options a System Value Option

The [ Accounts | Debt Management ] screen has a new option Include Credits in Periods which affects the contents of the grid.

BENEFIT: It is now possible for users to include customer credits in the period data displayed on the grid in the [ Accounts | Debt Management ] screen, ensuring that users do not unnecessarily chase customers based solely on invoice data.

[016303] Improve Multi-currency support on Debtors Detail Report

The Debtors report available from the context menu in the [ Accounts | Debt Management ] grid now includes the foreign currency values and respects the show in base currency filter.

BENEFIT: Debt chasing for foreign currency customers is now far easier to manage, as foreign currency amounts will be displayed correctly, when not viewing the detailed report in base currency.

[015926] Prevent users from Editing or Deleting Journals.

The options to Edit and Delete journals have been removed from the Related Journal Entries dialog. Users will need to manually reverse journals.

BENEFIT: It will no longer be possible for users to edit or delete journals in any situation, making your accounts even more robust.

[016267] Intrastat / Country VAT support for Monaco

Khaos Control has been modified to take note of HMRC VAT Notice 725; this is only of interest if you deal with Monaco and France and are registered for VAT in that principality or country. We have introduced an internal mapping table which, for invoices for certain countries, will translate the relevant country they report as.

Note: This presently only holds Monaco but allows for future expansion as needed.

BENEFIT: Khaos Control now provides Intrastat / Country VAT support for Monaco.

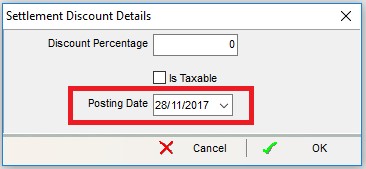

[016084] Purchase Invoice Settlement Discount Post Date modifications

The Khaos Control Purchase Invoice Settlement discount behaviour has been modified to use today as the default date in a new prompt to the user, rather than being hard coded to match the selected Purchase Invoice date. This is applicable in all places where this facility is available:

- Purchase Invoice grid right-click.

- Supplier Statement grid right-click,

- Supplier Payments dialog grid right-click.

BENEFIT: Purchase Invoice Settlement Discounts now use a consistent posting date by default.

8.135 onwards

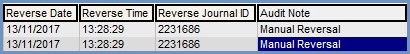

[015918] Payment Handling and other areas modified to ensure audit trail

The following areas have been modified (beyond existing restrictions which were already in place) so that deleting nominal transaction data is no longer possible or supported and ensures an auto-reversal trail is generated instead:

- Editing or Deleting Payments, including Sales Order Pre-Payments.

- Manually Reversed Journals.

- Un-issuing Sales Invoices. (This is a KCSL-only option - not for general client use)

- Un-posting Purchase Invoices. (Journals and SRNI reversed)

- Un-Deliver items (SRNI reversed)

- Deleting posted SP ledgers.

- Delete Opening Balance / Settlement Discount / Under-Over Payment Ledger Transactions.

BENEFIT: It will no longer be possible to delete nominal transaction data as and when users wish to. Instead they will have to commit reversing transactions which will be fully audited.

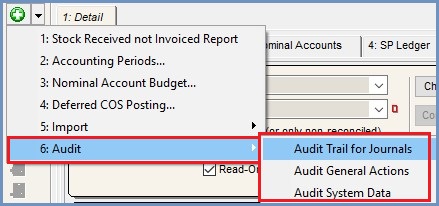

[012648] Audit added for accounts standing data activity

[System Values] user edits are now tracked in addition to some key [ System Data ] areas also being audited which are then visible in the Audit Log screen including:

- Tax Rates

- Currencies

- Currency Conversions

- Bank Accounts

- Brands

- Nominal Classifications

- User List properties.

BENEFIT: Users amending or adding to any of the data sets listed above will be fully audited, giving admin users greater visibility of why, how, who by and when their accounts configuration has been amended.

[016276] Future Payment days configurable

A new system values option Future Payment Day has been exposed in the [ Accounts | General ] section, so the number of days into the future payments can be processed can be controlled by a financial admin on the system.

- The default value for this is 14 days.

- Systems where previous bespoke changes have been made in this area will be respected.

[016465] General Accounts improvements

- Tax Rate column now available for Sales Order items and Purchase Invoice items within Configure Grid for those screens.

- Audit Log options modified so that hide empty did not exclude delete type entries.

- Audit Log visibility improved for delete actions.

- Editing of core Sequence values by Admin users is now recorded in the General Audit.

[ System Data | Currencies ]restrictions have been modified to prevent duplicate currency descriptions.

- Transaction Detail and Show Journal" Popup grids now includes the Tax Register Committed Date if applicable to transaction entries.

- Transaction Detail and Show Journal Popup grids now include Post Date and Post Time information.

- Show Journal Popup now include additional reversal information if the journal being viewed has subsequently been reversed.

- Manual Journals where a user answers No to the Tax Register popup are now recorded in the General Audit information. E.g. Manually posted Tax Commit Journals.

- New General Audit screen added to the Other Actions menu in Accounts alongside the other new audit options.

- General Audit information recorded for Accounting Period Closures has been improved to include more useful detail, not applied retrospectively.

- General Audit information recorded for Tax Commit has been improved to take note of UK / EC or the relevant Country if Country VAT is being processed in addition to the TAmount which was already being recorded, this will not applied retrospectively.

- Transaction Detail CSV export improved to show the actual file path to the user when performing this action.

- Quick Access option for System Data Audit Log added to Accounts Other Actions which defaults to the detail view and includes a new filter to show system data activity only.

- Accounts | Nominal Accounts, duplicate nominal account codes are now explicitly blocked and will raise an error when detected which replaces the previous warning.

- Deleting SP ledger will now auto-reverse the associated journals.

- The Nominal Account system no longer allows duplicate codes, previously a warning was displayed, this is now strictly prohibited and an error message will be encountered instead.

Support added for new Sequences to Khaos Control Cloud to facilitate the same transaction posting audit information available in Khaos Control.

BENEFIT: As listed above, small improvements to improve the audit information available in various areas of the system.

Appendix

General Audit Action Listing

Activities which are now included in the General Audit relating to accounts:

- Tax Register Committed (improved)

- Accounting Period Closed (improved)

- Accounts Cleardown

- Bank Reconcile Commit

- Tax Register Country Change

- Sequences Modified (new)

- Tax Journal Not Registered (new)

- DN Booked In

- PI Posted

- PI Unposted

- SP Ledger Deleted

- Journal Deleted (deprecated, but will display for old records)

- Journal Edited (deprecated, but will display for old records)

Other notable but not Accounts specific activity that is included in the General Audit:

- Company Merge

- Statement Run

- System Values Accessed

- File Modified (basic reports)