System Data Tax Rates

Tax Rates

The [ System Data | Accounts | Tax Rates ] screen is used to set up the Tax (VAT) Rates and their values to be used on the system, see How To: Change Tax (VAT) Rates. The tax rates setup here are available via the drop-down throughout the system, for example the Base Tax Rate field in the [ Stock | Detail | Accounting ] screen. Users can check the tax rates when running the Health Check.

Note: The tax rate used for calculating delivery VAT is a hidden system value. The current delivery VAT setting can be determined by running Health Check (v3r or later).

Tax Rates Grid

- Code: the display order of the rates which will be exported in an XML feed and also in the VAT Return.

- Description: the description of the VAT rate for example; 'Standard', 'Zero', 'Exempt', 'Reduced', 'Old Rate (pre-Dec 2008 & 2010)' etc.

Note: if the standard rate changes, amend the rate against the 'Standard' description. - Rate: the percentage rate of VAT for example '20', '0', '5', '17.5' etc.

- Country Tax:

- Country: the country the tax rate is applicable to.

- Delivery Rate: this column is only visible when Country Specific VAT has been enabled. It allows the system to use a country's tax rate for the delivery charge. Although the rate can be added here it is better to add it in the

[ System Data | International | Countries ]screen, see How To: Setup Country Specific VAT. Any tax rate entered in the Counties screen will be added to this grid.

- Default checkbox: the base rate to use for (primary) delivery calculations, or anything similar. It is the rate loaded as the default when the system starts.

Note: only one should be ticked.

ticked.

Tax Rates Context Menu

- Apply Value Range: allows the user to specify a value that is to be applied to all of the currently selected rows/items for the current column.

- Clear Selection: deselects the currently selected line(s).

Note

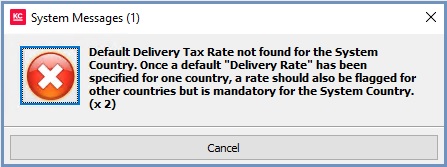

The following error occurs because once Delivery Tax has been ticked on an individual country's Tax Rate, it must also be ticked for all other countries or it will error:

For example, if you have ticked Delivery Tax for Australia but not the UK, you need to tick a Delivery Rate checkbox for the UK. You will also need to do this for other countries when setting up VAT rates for individual countries to ensure they have a delivery rate.

Note: it is not possible to untick the Delivery Rate checkbox.