System Values - Accounts - General

- WARNING: Changing these settings may cause unforeseen issues. If in doubt please check with KCSL's Support Team before making changes.

Miscellaneous

- Post header totals only (Sales):

: The system posts one account entry per sales invoice to the Stock and Stock COS nominals.

: The system posts one account entry per sales invoice to the Stock and Stock COS nominals. (default): The system posts an entry for each stock item line on the sales invoice to the Stock and Stock " COS nominals.

(default): The system posts an entry for each stock item line on the sales invoice to the Stock and Stock " COS nominals.

- Post header totals only (Purchases):

: The system posts one account entry per purchase invoice to the Stock nominal.

: The system posts one account entry per purchase invoice to the Stock nominal. (default): The system posts an entry for each stock item line on the purchase invoice to the Stock nominal.

(default): The system posts an entry for each stock item line on the purchase invoice to the Stock nominal.

Note: If post header Totals for sales or purchases is enabled, then the following nominal mappings cannot be used:- Manufacturer

- Level 2 Stock Type

- Stock Item

- Show Payment Date :

The first column in the

The first column in the [ Accounts | Bank Account ]grid displays the Payment Date. (default):The first column in the

(default):The first column in the [ Accounts | Bank Account ]grid displays the Date banked.

- Stock Received not invoiced:

: When stock is received on a delivery note, the value will be posted to the Stock and Stock - Received not Invoiced nominals. Subsequently, when the purchase invoice is posted, the system will reverse this posting and post the purchase invoice as normal to the stock account.

: When stock is received on a delivery note, the value will be posted to the Stock and Stock - Received not Invoiced nominals. Subsequently, when the purchase invoice is posted, the system will reverse this posting and post the purchase invoice as normal to the stock account.

Notes and Caveats:- If more than one invoice is associated with a Delivery Note, then these should be consolidated into one Purchase Invoice.

- The value journaled will use the value from the delivery note at the time the items are delivered in.

(default): The stock nominal is not updated with the value of delivered stock until the purchase invoice has been posted.

(default): The stock nominal is not updated with the value of delivered stock until the purchase invoice has been posted.

- Defer cost-of-sale:

(default): When a sales invoice is issued in the Sales Invoice Manager, the Stock COS and Stock nominals are not updated. This enables the user to review the stock cost of sales values and amend them before the posting is made.

(default): When a sales invoice is issued in the Sales Invoice Manager, the Stock COS and Stock nominals are not updated. This enables the user to review the stock cost of sales values and amend them before the posting is made.

Notes and Caveats- The date that the entries are posted is as per the option 'Invoice Date Basis' in

[ Edit System Values | Sales | Invoice Management ]. - The user can view the stock value when the invoice was issued and the current stock value when determining the value that should be posted to the accounts. They can amend the values if required before they are posted to the accounts.

- This option is particularly useful if you buy items and sell them before you post the purchase invoice that relates to them, or if you use BO/POs.

- The date that the entries are posted is as per the option 'Invoice Date Basis' in

: The Stock COS and Stock nominals are updated with the value of the stock at the time the sales invoices are issued in the Sales Invoice Manager.

: The Stock COS and Stock nominals are updated with the value of the stock at the time the sales invoices are issued in the Sales Invoice Manager.

See also Defer Cost of Sales.

- Use Issued Stock Value: This option is only applicable if the Defer cost-of-sale option (above) is ticked.

: The system will use the stock value at the point the sales invoice was issued when the Deferred Cost of Sales report is created.

: The system will use the stock value at the point the sales invoice was issued when the Deferred Cost of Sales report is created. (default): The system will use the current stock value when the Deferred Cost of Sales report is created.

(default): The system will use the current stock value when the Deferred Cost of Sales report is created.

- Monthly Debt Periods:

: The periods in the

: The periods in the [ Debt Management ]grid and on the Debt Summary grid in the[ Customer | Detail | Statement ]screen will be displayed in calendar months. (default): The system will use 30-day periods in the above grids.

(default): The system will use 30-day periods in the above grids.

- Fixed Weekly Periods:

(default): The periods in the Customer/Supplier Statement screen will be Monday - Sunday.

(default): The periods in the Customer/Supplier Statement screen will be Monday - Sunday. : The periods in the

: The periods in the [ Customer | Detail | Statement ]screen will be seven days from the current date.

- Due Date Periods:

The Period contents in the Debtors & Creditors list are driven by Invoice Due Date

The Period contents in the Debtors & Creditors list are driven by Invoice Due Date : (default) The Invoice Date is used to calculate which period an Invoice appears in..

: (default) The Invoice Date is used to calculate which period an Invoice appears in..- Include Credits and Payments in Debt Periods: If checked, the option to show unallocated Credits and Payments within the Periods of the Debt Management will be available to users of the Accounts screen.

- Profit and Loss Order By Nominal Code: When ticked, the Profit and Loss data will be ordered by Nominal Account Code within each section; this is the default for this option. When not ticked, the information will be ordered by Account Name instead

- Exchange Rates Popup Updates System Data: Controls whether the option in the conversion rates popup called "Update System Data" is ticked by default

- Profit and Loss: Nominal Account Budgets: Controls whether the option and associated features for nominal account budgets are displayed in the Profit and Loss screen.

- Future Payment Days: This value limits the number of days into the future any payment transaction can be posted into the Nominal Accounts. This allows your financial administrator to prevent users from posting transactions into the future beyond a reasonable limit. We recommend a default of 14 days.

- Accounts Integration: When enabled, you will be able to export KC generated invoices (and their specific simple payments) to Xero or Quickbooks. With this enabled you should use your external accounts package and not KC to maintain your accounts, do your debt chasing and reconcile your bank accounts.

- Intrastat - Include Delivery Charge: Include delivery charges in the intrastat report by default. This can be overridden per-report in the Accounts window.

- HMRC Tax Submission: Pick how you submit your tax details to HMRC.

- Country VAT EC Sales Excluded: Exclude Country specific VAT return EC Sales net transactions from UK VAT Return. This overrides/supercedes the setting in [System Data ¦ Countries ¦ Include on UK Vat Return]. Please ensure this option is set according to your accountants/hmrc recommendations for your business.

- Reconciliation date difference allowance (default=0): The number of days difference there can be between reconciled transactions. This applies to the reconciliation processes accessed from Other Actions on the accounts screen.

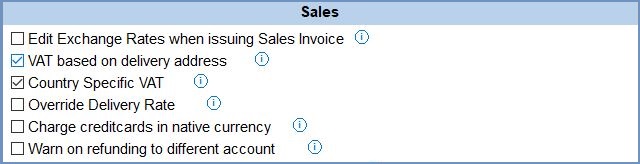

Sales

This is where you define how you wish the system to behave when selling goods to customers.

- Edit Exchange Rates when issuing Sales Invoice:

: When issuing a sales invoice that is for a non-base currency, the system will ask the user if they wish to review the exchange rates before issuing. If the user selects Yes, the Exchange Rates dialog will be displayed enabling the user to update the exchange rates before posting foreign currency invoices to accounts.

: When issuing a sales invoice that is for a non-base currency, the system will ask the user if they wish to review the exchange rates before issuing. If the user selects Yes, the Exchange Rates dialog will be displayed enabling the user to update the exchange rates before posting foreign currency invoices to accounts. (default): The system will issue the sales invoices and the accounts will be updated using the current conversion rate as set up in

(default): The system will issue the sales invoices and the accounts will be updated using the current conversion rate as set up in [ System Data | International | Currency Conversions ].

- VAT based on delivery address (default=ticked):

(default): VAT inclusion/exclusion is calculated based on delivery address.

(default): VAT inclusion/exclusion is calculated based on delivery address. : VAT inclusion/exclusion is calculated based on the customer's country.

: VAT inclusion/exclusion is calculated based on the customer's country.

Notes and Caveats:- We are looking to make changes to this area to allow more flexibility with regards which address the VAT is based on; invoice, delivery or customer's country.

- In cases where an overseas customer is collecting goods direct from yourselves, the Sales Order's Delivery Address should be called something like "Customer Collection" and set to "United Kingdom" for VAT to be correctly charged (similar considerations apply when you are sending the goods to the Customer's own shipping agent).

- Please refer to HM Revenue & Customs website "VAT refunds for visitors to the UK for details of the process you need to follow if your customer is to successfully obtain a VAT refund.

- Country Specific VAT: If ticked, the usage and configuration of VAT for each individual country will be enabled, see Country Specific VAT and How To: Setup Country Specific VAT for more information.

- Override Delivery Rate:

: If a sales order contains ONLY non-vatable, i.e. Zero or Exempt, items, the system will treat the Delivery Amount on the sales order as zero rated for VAT purposes. For example, if delivery is normally £3.50 including VAT when an order contains vatable items it will be £2.92 if the sales orders only contains zero rated items.

: If a sales order contains ONLY non-vatable, i.e. Zero or Exempt, items, the system will treat the Delivery Amount on the sales order as zero rated for VAT purposes. For example, if delivery is normally £3.50 including VAT when an order contains vatable items it will be £2.92 if the sales orders only contains zero rated items.  (default): VAT will be applied to the delivery rate, even when all the sales order items are Exempt and/or Zero rated.

(default): VAT will be applied to the delivery rate, even when all the sales order items are Exempt and/or Zero rated.

- Charge credit cards in native currency :

: when charging a credit card, all transactions with the bank are charged in GBP (converting from the customer's currency as required).

: when charging a credit card, all transactions with the bank are charged in GBP (converting from the customer's currency as required). (default):

(default):

- Warn on refunding to a different account: If ticked, will show a warning when refunding to a different payment type or bank account than the original sales order payment.

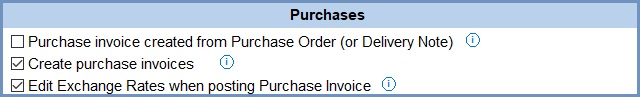

Purchases

This area is where you configure the behaviour of the system when dealing with the accounts side of purchasing goods.

- Purchase invoice created from Purchase Order (or Delivery Note) :

: Purchase invoices will be created from purchase orders, so you will be paying for goods you may not have received.

: Purchase invoices will be created from purchase orders, so you will be paying for goods you may not have received. (default): Purchase invoices are created from delivery notes, so you are paying for what has been delivered.

(default): Purchase invoices are created from delivery notes, so you are paying for what has been delivered.

- Create purchase invoices (default=ticked):

(default): The system will create purchase invoices from purchase orders or delivery notes.

(default): The system will create purchase invoices from purchase orders or delivery notes. : The system will not create purchase invoices from purchase orders or delivery notes, instead purchase invoices must be manually posted via

: The system will not create purchase invoices from purchase orders or delivery notes, instead purchase invoices must be manually posted via [ Accounts | SP Ledger ]section.

- Edit Exchange Rates when posting Purchase Invoice: when

ticked a dialog will be displayed before posting foreign currency invoices to accounts, allowing you to alter the exchange rates.

ticked a dialog will be displayed before posting foreign currency invoices to accounts, allowing you to alter the exchange rates.  : a dialog will be displayed before posting foreign currency invoices to the accounts, allowing the user to change the exchange rates.

: a dialog will be displayed before posting foreign currency invoices to the accounts, allowing the user to change the exchange rates. (default):

(default):

Note: new systems are normally supplied with (default) values shown.

See Also

The 'Include Credits in Periods' checkbox will be displayed in the

The 'Include Credits in Periods' checkbox will be displayed in the [ Accounts |Debt Management ]screen, which by default will be unticked. This will allow the user to view the balance for each period in the grid, taking into account payments and credit notes. The Unalloc column will display the total value of any unallocated payment and credit notes. This does not affect Statements and LP Value calculations. (default): The 'Include Credits in Periods' is not visible.

(default): The 'Include Credits in Periods' is not visible.

(default): The Profit and Loss report in Accounts will be ordered by Nominal Account Code within each section.

(default): The Profit and Loss report in Accounts will be ordered by Nominal Account Code within each section. : The Profit and Loss report will be ordered by the Account Name within each section.

: The Profit and Loss report will be ordered by the Account Name within each section.

(default): The 'Update System Data' checkbox in the Exchange Rates dialog will be ticked by default. Any currency conversion rates entered here will update the rate in

(default): The 'Update System Data' checkbox in the Exchange Rates dialog will be ticked by default. Any currency conversion rates entered here will update the rate in [ System Data | International | Currnecy Conversions ]and will then be the system default conversion rate for that currency. : The 'Update System Data' checkbox in the Exchange Rates dialog will be unticked by default. However, the user can tick (or untick) the checkbox as required.

: The 'Update System Data' checkbox in the Exchange Rates dialog will be unticked by default. However, the user can tick (or untick) the checkbox as required.

: Enables the monthly budget functionality in the Accounts area of the system, allowing users to set up monthly budgets against different nominal accounts and then analyse the results month by month in the P&L.

: Enables the monthly budget functionality in the Accounts area of the system, allowing users to set up monthly budgets against different nominal accounts and then analyse the results month by month in the P&L. (default): The Nominals Account Budget dialog is not available, see How To: Set up Budgets against Nominal Accounts and How To: Analyse Budget Figures.

(default): The Nominals Account Budget dialog is not available, see How To: Set up Budgets against Nominal Accounts and How To: Analyse Budget Figures.

: Khaos Control can be setup to allow invoices and specific simple payments to be exported to an external accounts package. Once enabled, the external accounts package and not Khaos Control should be used to maintain your accounts including debt chasing and bank reconciliations.

: Khaos Control can be setup to allow invoices and specific simple payments to be exported to an external accounts package. Once enabled, the external accounts package and not Khaos Control should be used to maintain your accounts including debt chasing and bank reconciliations. (default): The options for setting up external accounting package are not enabled.

(default): The options for setting up external accounting package are not enabled.

Notes and Caveats: Transactions, including reconciliations that have been entered in the external accounts package will not be imported into Khaos Control.

: The delivery charge for each Sales Order (Net) is added proportionally to the totals for that order.

: The delivery charge for each Sales Order (Net) is added proportionally to the totals for that order. (default): Delivery charges are not included in the Intrastat report.

(default): Delivery charges are not included in the Intrastat report.

Notes and Caveats: In the[ Accounts | Tax (VAT) | Intrastat ]screen, a checkbox option Include Delivery Charge will include the delivery charge as if the option is ticked.

- Not Decided (default): this will disable both Commit and Digital Commit options and display an error message directing the user back to this screen to make a selection.

- Manually: The digital submissions button is disabled in the accounts screen.

- Digitally: The manual commit options are disabled, although the VAT return can still be viewed.

Note: where a previous digital submission is detected, the default will be 'Digitally'. If the user attempts to change this, they will receive a warning that previous submissions have been digital.

Notes:

- Please ensure this option is set according to your accountants/HMRC recommendations for your business.

- This option overrides/supersedes the option Include on UK VR in [System Data Countries|

[ System Data | Countries ]]]. - For the values to be posted for an EU member country:

- This exclude option must be unticked (off).

- The Includes in Include on UK VR in [System Data Countries|

[ System Data | Countries ]]] must be ticked (on) on a per country basis.