Accounts Bank Accounts Tab

For the Other Action Menu options (press F9 or ![]() ) see Accounts Other Actions Menu.

) see Accounts Other Actions Menu.

Contents

- WARNING: When setting up a bank account do not rename or reuse existing bank accounts or change the currency of an existing bank account.

Bank Accounts Overview

Bank accounts are used for recording deposits and payments made in Khaos Control. When payments are made, either manually or automatically, they need to be assigned to a bank account. For the system to operate correctly, at least one bank account is required.

- Khaos Control allows for multiple bank accounts.

- It is possible to transfer money between accounts, see How To: Journal between Nominal Accounts and How To: Journal between Nominal Accounts using a non-Sterling currency.

- You can also add or make adjustments for interest or bank charges, see How To: Journal between Nominal Accounts and How To: Enter a single line SP Ledger entry.

- Each bank account may have a currency assigned to it.

Note: the Bank screen will display entries in the currency of the bank account. - It is possible to create Debtor Credit Card Accounts to manage credit card sales.

- Khaos Control can also be used to "reconcile" transactions against a bank statement or report (e.g. credit card processing report), ensuring that the bank's overall balance is correct, see How To: Perform a Bank Account Reconciliation.

The procedure for setting up Bank Accounts in described in How To: Create a New Bank Account.

The Bank Account screen consists of three areas:

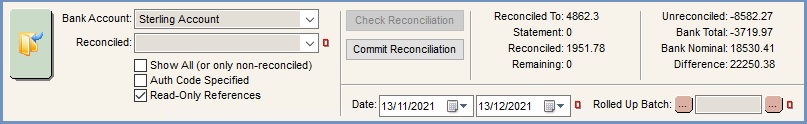

Filters and Information Area

Filters

- Go button: the Go button needs to be pressed after the bank has been selected to populate the grid.

- Bank Account: displays all available bank accounts.

- Reconciled: used to display all items belonging to a specific reconciliation.

- Show All (or only non-reconciled):

- TICKED includes all transactions.

- UNTICKED shows only non-reconciled transactions.

- Auth Code Specified: filters the grid so any card payments which have not been authorised will be hidden when the filter is active. Its useful when reconciling bank accounts which include a lot of PREAUTHED payments which are not yet final, excluding these items so you can get on with the job of reconciling the real money.

Note: not applicable for cash and cheque items. - Read-Only References: UNTICKED and in Edit Mode entries can be made in the Pay Code and Reference fields.

- Date Range (

/

/ traffic light filter): filter the grid by the selected date range.

traffic light filter): filter the grid by the selected date range. - Rolled Up Batch (

/

/ traffic light filter): filters by rolled-up batch description.

traffic light filter): filters by rolled-up batch description.

Bank Reconciliation Area

button: compares the reconciled amount with the running total from the bank statement sheet.

button: compares the reconciled amount with the running total from the bank statement sheet.-

button: this button is used to commit the reconciliation, see How To: Perform a Bank Account Reconciliation

button: this button is used to commit the reconciliation, see How To: Perform a Bank Account Reconciliation

- Reconciled To: the last agreed reconciled balance.

- Statement: the amount on the statement as entered by the user.

- Reconciled: the amount updated as the Recon checkbox is ticked.

- Remaining: the difference between the statement and reconciled amounts.

Bank Account Status Panel

The bank account status panel shows the current state of an account according to the information held in Khaos Control.

- Unreconciled: the total of the Banked grid. This field displays in the Bank Accounts currency.

- Bank Total: the difference between Reconciled To and Unreconciled. This field displays in the Bank Accounts currency.

- Bank Nominal: is the total in the Bank Nominal account. This always shown in base systems base currency.

- Difference: is the Bank Nominal - Bank Total

- Notes:

- This field should be the same as the un-banked total.

- This field will always be hidden when the bank account is of a foreign currency because Bank Nominal is always in the base currency which is Sterling Pounds.

- Notes:

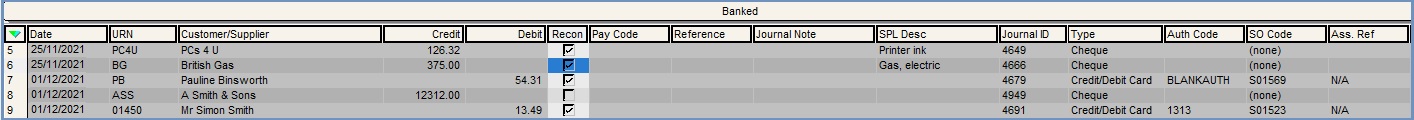

Banked Grid

This grid is populated with data that has been through the banking process. Double-clicking a transaction displays the Related Journal Entries, thereby showing the double-entry or the reconciled detail, if the transaction is already reconciled. The fields displayed on this grid are described below:

- Date : date item was banked.

Note: the date can be changed to display the Payment Date using the option Show Payment Date in[ System Values | Accounts | General ]. - URN : the URN of the customer or supplier and is populated automatically.

- Customer/Supplier: the name of the customer or supplier and is populated automatically.

- Credit and Debit: the amount either going out of or into the bank account.

- Recon check box: during a reconciliation indicates whether the item has been checked against the bank statement.

- Pay Code : populated from the following fields although can be edited in this screen:

- The Voucher Ref or Cheque Ref in the

[ Sales Orders | Payment ]tab. - The Source # in the

[ Customer / Supplier | Detail | Statement ]tab Allocate From grid. - The Code field in the New Payment Dialog.

- The Voucher Ref or Cheque Ref in the

- Reference : displays paying-in reference if entered during the banking process. It may be utilised at user's discretion for other custom purposes.

Note: for the user to edit the Pay Code and Reference columns the Read-Only References checkbox above the grid must be un-ticked. - Journal Note: the note entered when journalling in the Journal Grid in the

[ Accounts | Nominal Accounts ]screen. - SPL Desc: the note as entered in the Description for the entry in the

[ Accounts | SP Ledger ]screen. - Journal ID: the journal number automatically created when the journal was posted.

- Type: the payment type for the entry for example cheque, cash, journal.

Note: if BACS is used as the payment type when a sales order is raised, then the payment type shown in the grid will be 'Payment Advice'. If a payment is raised as BACS via the customer statement, it will show in the grid as 'BACS'. - Auth Code : where a Debtors Credit Card Account has been set up, this field is automatically generated as a result of the creation of a sales order or invoice.

Note: this field is not applicable for cash and cheque items. - SO Code: displays the Sales Order number associated with the payment (please see Note 2 below).

Notes:- Credit Card payments are only allocated to Sales Orders when their corresponding Invoice is issued. If there are un-issued invoices then no Sales Order code will be displayed.

- For credit card payments that have been used to pay multiple invoices, no reference will be displayed.

- Ass Ref: the Associated Reference defined against the sales order which can be used to aid the reconciliation of orders for different channels, for example; Amazon, Websites, eBay etc...

Banked Grid Context Menu

- Show Journal Pop-up: displays double-entry data for selected entry.

- Goto Customer/Supplier: displays details for selected Customer/Supplier, if applicable.

- Goto Source Document: displays original Sales Order for selected entry, if applicable.

- Reconciliation:

- Unreconcile: Unreconciles the WHOLE of the latest reconciliation.

- Manually Change Reconciled Balance: used to enter reconciliation balance at set-up. This should not be required after setting up the system, unless an error has been made. This option requires an Admin Password to be setup which then controls who is able to use this option.

- Rollup Batches:

- Add selected to Rollup Batch: the user can select banked items that are NOT part of batch and add them to any open batch or a new batch.

- Close Batch: opens a popup with a list of all open batches that the user can close.

- Open Batch: opens a popup with a list of all closed batches that the user can open.

- Show Rolledup Transactions: opens the Rolled-up Payment Batches dialog which displays all rolled up transactions for the current financial year.

Notes:- There is no access to the journal from the Rolled-up Payment Batches dialog.

- Batches are displayed in the Customer/Supplier column in the Banked Grid as Rolled Up Batch - (Sequential number).

- The date of the batch can be changed using the Change Date option in the context menu.

- Double-clicking on a batch loads the Transactions dialog detailing all the entries in that batch.

- Change Date (selected rows): allows the date to be changed for a row or selection of rows including batches; requires Edit Mode. It does not affect the date shown in the company statement screen.

- Unbank Selected Payments: allows the user to unbank the selected payment in the upper Banked grid. Saving the screen applies the unbank, it is not done during the edit session.

- Select Rows by Reference: displays all entries made for a specific paying in reference (shown in green). Uses the paying in reference for the selected line and amends total to reflect highlighted entries. This is a particularly useful function when reconciling with a bank statement.

- Select Rows by Date: displays all entries made for a specific date (shown in green). Uses the date for the selected line and amends total to reflect highlighted entries. This is a particularly useful function when reconciling with a credit card processing report.

- Apply Value Range: allows the user to specify a value that is to be applied to all of the currently selected rows/items for the current column.

- Clear Selection: deselects the currently selected line(s).

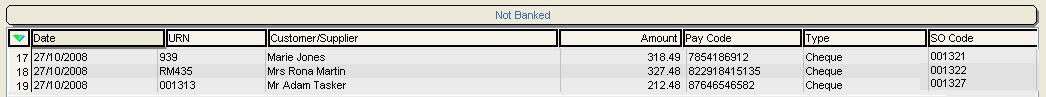

Not Banked Grid

This grid is populated with payments that have not yet been through the banking process. By default any payments that are of type Cheque or Cash appear on the Not Banked grid. Items in the Not Banked grid can be moved to the Banked grid after banking is completed, this procedure is explained in How To: Bank Items, payments can also be banked automatically, this is set in the [ System Data | Accounts | System Payment Types ] screen.

- Date: the date of the payment.

- URN: the customer or suppliers URN.

- Customer/Supplier: the name of the customer or supplier.

- Amount: the amount of the payment.

- Pay Code : populated from the following fields although can be edited in this screen:

- The Voucher Ref or Cheque Ref in the

[ Sales Orders | Payment ]tab. - The Source # in the

[ Customer / Supplier | Detail | Statement ]tab Allocate From grid. - The Code field in the New Payment Dialog.

- The Voucher Ref or Cheque Ref in the

- Type: the payment type for the entry for example cheque, cash, journal.

Note: if BACS is used as the payment type when a sales order is raised, then the payment type shown in the grid will be 'Payment Advice'. If a payment is raised as BACS via the customer statement, it will show in the grid as 'BACS'. - SO Code: the Sales Order number associated with the payment is displayed as a heading on the right- hand end of the grid(please see Note 2 below).

Notes:

- Credit Card payments are only allocated to Sales Orders when their corresponding Invoice is issued. If there are un-issued invoices then no Sales Order code will be displayed.

- For credit card payments that have been used to pay multiple invoices, no reference will be displayed.

Not Banked Grid Context Menu

- Go To Customer/Supplier: displays details for selected Customer/Supplier.

- Bank Selected Items: moves the selected transaction(s) to the Banked grid.

- Clear Selection: deselects the currently selected line(s).

Hints & Tips

- When searching for transactions, remember to use the grid's search facility by typing amounts directly into the debit and credit columns.

- If a transaction appears on the bank account but not on the system, the missing transaction can be entered without saving or ending the reconciliation. Open the required screen, e.g. SP Ledger and enter the payment details. Return to the

[ Bank Account ]screen and click on Refresh F5 to display the created entry. - To quickly select all transactions that have the same paying-in reference (assigned when banking), right-click on the Banked grid and choose 'Select Rows by Reference'.

- After a reconciliation has been performed past reconciliations can be displayed using the "Reconciled" drop-down list. See "How To: View a previous reconciliation" for further information.