How To: Understand different types of Sales Order

Khaos Control uses several different types of Sales Order, each of which is associated with a different Sales Order process.

Selling Goods and Services

Khaos Control allows you to process firm sales; it also records details of sales quotations you have sent, allowing them to be readily converted into firm sales once the customer has accepted your quote.

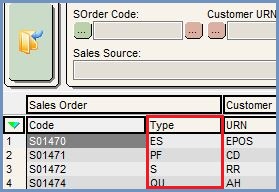

- Sales Order (S): whenever a firm sale is made, a normal sales order can be entered using the Sales Order screen or imported from a website, etc. Assuming sufficient stock exists, it will be assigned when the Sales Order is saved.

- Note: Where items are sold through the EPOS till, this same type of Sales Order is created, but with an "ES" prefix.

- Note: Where items are sold through the EPOS till, this same type of Sales Order is created, but with an "ES" prefix.

- Proforma Order (PF): this is used should you decide, for any reason, not to accept a firm order unless the customer has paid in advance. Assuming sufficient stock exists, it will be assigned when the Sales Order is saved.

- Sales Orders can be manually set to this type using the drop-down list box on the main tab.

- Where you always want a specific customer to pre-pay, they can be defined as such (by ticking the 'Proforma Customer' checkbox on their customer screen) and by setting the Proforma Order Type to 'Proforma' in

[ System Values | Sales | Order Display ].

Note: despite its name, a Proforma Invoice is a sales order document, NOT a sales invoice. See comments from HM Revenue & Customs website quoted in the Accounts Glossary regarding date of supply for VAT purposes: the tax point occurs whenever goods are supplied or payment made, whichever occurs first. To achieve this in Khaos Control, simply ensure that the System Values' setting 'Invoice Date based on when invoice was printed' is ticked and print the Sales Invoice on the same day you receive payment, regardless of whether or not you would normally print the Sales Invoice at this stage. The act of printing the Sales Invoice (and telling Khaos Control that it has been printed) sets the Tax Point.

- Sales Quotation (QU): a sales order of this type allows a quotation to be created for a customer and sent to them for their approval. As it is not a firm order, no stock is assigned to a Sales Quotation.

Sales Returns and other Credit Notes

You may agree to your customer returning goods, perhaps because they were faulty, or for other reasons. Occasionally your courier might lose a consignment. In each of these cases a document, known as a credit note, would normally be sent to the customer showing the allowance given for the faulty/missing goods. A sales order of this type is called a credit note because the customer's account will be credited with the amount of the allowance, to show the reduction in the amount s/he owes. Khaos Control features an automated Sales Return process and additionally provides a manual credit note facility:

- Credit Note (C): A manual credit note can be created and processed should the credit NOT be linked to an existing Sales Order on Khaos Control (e.g. where the goods were sold using your previous system, or where monies are due to your resellers in respect of such payments as overrider discounts/turnover rebates, listing fees, promotional costs and advertising rebates).

- Sales Return Credit (RC): a sales order of this type is a credit that is created from items that have been returned.

- Sales Return Exchange (RE): a sales order of this type is generated from a return and specifies the exchange items.