Sales Orders Additional Tab

For the Other Action Menu options (press F9 or ![]() ) see Sales Orders Other Actions Menu.

) see Sales Orders Other Actions Menu.

The [ Sales Order | Additional ] tab enables the user to add additional information about the order, check the break-down of the order amounts, add and check any Keycode added to the order and enable/disable other options. The [ Sales Order | Additional ] tab consists of three areas:

The sales order grid is common to all sales order detail tabs.

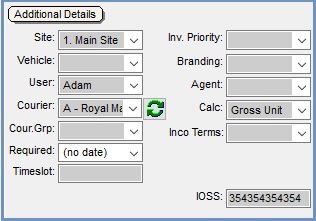

Additional Details

- Site: this is the stock control site from which the system will take stock to fulfil the sales order's requirements.

- Vehicle: if you are using Khaos Control to maintain data on your delivery fleet, then you can use this option to tell the system the vehicle that was used to deliver the sales order's goods to the customer. This information is then collated against vehicles and displayed in a vehicle report (see

[ Repeat Orders | Vehicles ]tab for more information). In the Food & Meat version of Khaos Control this facility is particularly useful for monitoring weights and vehicle load capacity. - User: the user assigned to the sales order.

- Courier: the courier being used to ship the sold products to the customer can be selected here. The courier can also be selected as part of the Shipping stage of the Sales Invoice Manager, which also enables you to specified consignment references and ship dates.

: if the courier has been changed then pressing this button will set the courier to the courier the system thinks it should be.

: if the courier has been changed then pressing this button will set the courier to the courier the system thinks it should be.- Cour. Grp: the Courier Group is where the type of courier service for example standard, urgent, pallet or Amazon Prime is defined. This can be for manually created orders, imported orders and orders imported from channels such as Amazon and eBay. Courier Groups act like an aggregator so when sales orders are imported, either from a channel or website, they are assessed within the right courier group to find the relevant courier service that matches.

- Required: The required by date is a free date field which is commonly used to define a must deliver date. This does not affect the delivery date as defined in the

[ Sales Order | Detail | Main ]tab. This date can be filtered on in the Sales Invoice Manager. - Timeslot: a freetext field that is available in the following areas:

- The Available Tags in the Invoice trigger type emails.

- Basic Reports for Picking and Delivery Note.

- Inv Priority: an invoice priority can be attached to a sales order and are confirmed when the sales order is saved. The benefits of Invoice Priorities include being able to see sales order priorities in the Sales Invoice Manager grid, they can also be filtered and sorted on in the system. For more information see

[ System Data | Invoice Priorities ]which is where they are defined. - Branding: allows the user to select a particular brand from the drop-down menu. This is set up in

[ System Data | Branding ].

Note: on a sales order if a sales source associated with a brand is selected it will apply the brand to that sales order. If a different sales source that doesn"t have a brand attached to it is then selected the original brand will still apply. - Agent: an agent can be assigned to the sales order. This is set up in

[ System Data | Agents ]. - Calc: can be changed to force the sales order to calculate in particular fashion, see Net and Gross Prices and the 'Calculate unit based on taxability' option in

[ System Values | Sales | Pricing ]. This is useful when you deal with retail and trade customers, as retail should be set to calculate on Gross Unit, e.g. £19.99 x 5 = £99.95; and trade could be set to calculate on Net Unit, e.g. £17.01 x 5 = £85.05 + VAT = £99.93. The default calculation method can be set against Company Classes in System Data. Users should be aware of setting their Price Lists to Net and their Calc Method to Gross, as this may not give the desired results. - Inco Terms: the INCO Term used with foreign deliveries for example Free on Board (FOB), Delivered Duty Unpaid (DDU) and Delivered Duty Paid (DDP). These can be displayed on the Customs Invoice, see How To: Setup INCO Terms for use with Sales Orders and Basic Reports.

- IOSS: the EU VAT Import One-Stop Shop (IOSS) number which can be from:

- Channel: if the sales order is imported from a channel that has an IOSS number defined.

- Brand: if the order has a brand applied that has an IOSS number.

- Company: if there isn't an IOSS number for the order as the result of being imported form a channel or having a brand applied, then the IOSS number will be taken from

[ System Values | General | Your Company ].

Order Amounts

- Discount Val: the total amount of discount from a keycode across all lines in the sales order. This is the discount amount set against a keycode. The values per line can be seen if you configure the grid to Un-Hide the columns Disc (N) and Disc (G), see Grid Configuration. This amount can be changed by the user. The adjacent refetch button will change the amount back to what the system thinks it should be.

- DiscL: is the total discount that is applied to the sales order. If Calculate VAT is on then the discount includes VAT, and does not include VAT if off.

- Delivery: the delivery amount, if applicable to this order. If Delivery VAT is on then the delivery charge includes VAT and does not include Tax if off.

- Net Total: the sales order's total value, before VAT is added. If delivery is applicable to this order then the net amount will also be included in this total.

- Tax Total: the total value of the tax (VAT) applicable to the order. If delivery is applicable to this order and VAT applicable to the delivery rate, whether defined in

[ System Data | Delivery Rates ]or the Delivery VAT checkbox on this tab. The VAT element will be included in this total. - Order Total: the sum of the Net and Tax totals.

- Total Weight: the total weight of the sales order based on the weight set against each stock item in the Avg Weight field in

[ Stock | Details | Properties ]screen and the multiple of that item on the sales order. In edit mode the user can specify an alternative weight, for example if they actually weighed the total order.

Note: the system will re-evaluate the courier and delivery charge every time the weight is changed and the order Refreshed F5. The system will ONLY re-evaluate the if valid Courier Banding and Delivery Rates are applicable. - Currency: the currency of the order as set against the customer in the General area in their

[ Customer | Detail | Financial ]screen.

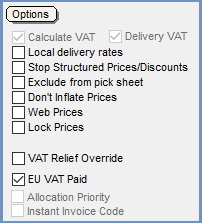

Options

- Calculate VAT: when ticked, the system WILL calculate VAT on the order.

- Delivery VAT: when ticked, the system WILL calculate VAT on the delivery charge.

- Local delivery rates: when ticked, a UK delivery rate is enforced irrespective of the country in the delivery address.

For Example: You have 2 rates for a courier defined, £4.00 for UK and £6.00 for Germany. If you create a Sales Order with a German delivery address, the system would normally charge £6.00. With this option ticked, however, the system would charge £4.00. - Stop Structured Prices/Discounts: if

ticked, the system will ignore special prices set against customers, classifications, catalogues, etc, and revert back to the stock item's list price; the sell price recorded against it in the

ticked, the system will ignore special prices set against customers, classifications, catalogues, etc, and revert back to the stock item's list price; the sell price recorded against it in the [ Stock | Detail | Properties ]tab. See the Promotion Price Lists tab for more information on Khaos Control pricing rules.

Note: this option will be ticked by default if the sales order is being raised against a customer whose Company Class has Manual Prices within System Data. For more information, please see Company Classes.

within System Data. For more information, please see Company Classes. - Exclude from pick sheet: if ticked this order will not appear as part of the Combined Pick Sheets within the Sales Invoice Manager. It will still appear on Single and Batch Pick Tickets.

- Don't Inflate Prices: When selling to a country that is not VATable, you may decide to keep the prices as they would be if VAT were included. The option will stop this "price inflation" from taking place on this sales order. This value comes from the Company Class, as defined in System Data.

- Web Prices: uses the price set in

[ Stock | Detail | Telesales / Internet ]tab. If no web price is specified against the stock item the system will look for a structured price (Price List) and then the Sell Price. - Lock Prices checkbox: Shows whether prices have been locked on this Sales Order as described in How To: Lock Prices in Sales Orders.

Notes:- If a sales order be saved with prices locked, then if the sales order is reopened and unlocked, the price fields will be recalculated when it is saved.

- Lock Prices refers to the stock item prices only, not the delivery charge. Any changes which update the delivery charge, for example applying a keycode will result in the recalculation of the order total.

- VAT Relief Override: this option is for imported sales orders where the import file contains the option for VAT Relief and will be ticked or unticked depending on what the import file option is set to for the order:

- TICKED: any lines for stock items on that sales order with the 'VAT Relief Qualified' checkbox enabled in

[ Stock | Detail | Options ]will have VAT Relief turned on. - UNTICKED: any lines for stock items on that sales order with the 'Vat Relief Qualified' checkbox enabled may still have VAT Relief turned on, if the order matches the following conditions:

- The Brand dropdown in

[ Sales Order | Detail | Additional ]is set to a brand that has the 'VRQ' tickbox ticked in[ System Data | Sales Order Processing | Branding ]. - The customer for whom the sales order was raised has the 'VAT Relief Qualified' ticked in

[ Customer | Detail | General ].

Notes:

- If VAT Relief is turned on for a sales order item line, this means that the tax rate for that specific item line will be set to Exempt and therefore the Tax amount will automatically calculate as 0.00 for that item line.

- The VAT Relief Override checkbox is intended for use by order imports only and cannot be changed by a user.

- The Brand dropdown in

- TICKED: any lines for stock items on that sales order with the 'VAT Relief Qualified' checkbox enabled in

- EU VAT Paid: this option is ticked if the sales order is for an EU customer and it is over €150.

- Allocation Priority (default=unticked): when ticked, this will override the oldest order first stock allocation the system normally follows allowing the telesales user to prioritise stock allocation for the order, so stock will be allocated before other orders, see How To: Prioritise Stock to Urgent Sales Orders.

- Instant Invoice Code: when ticked, the system will generate an invoice number without having to print the invoice.

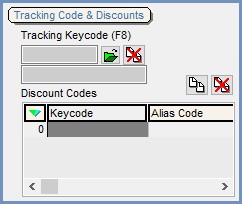

Tracking Code & Discounts

Tracking Keycode (F8)This area displays what tracking keycode campaigns and promotions have been added to the sales order. There is a short-cut key F8 that will open the key code popup from wherever you are in the sales order. Once a key code has been assigned to a sales order, that key code is recorded against that customer in their [ Customer | Detail | CRM | Key Codes ] tab. Key codes can be set-up to use prices from a catalogue and/or to apply certain special offers to the sales order; or they can simply be used to track the response from a mailing campaign (see Keycodes for more information). Keycodes can be applied to credit notes, however, any discounts are not applied. This allows keycode analysis and sales analysis to take into account credit notes.

: opens the Keycode Lookup dialog enabling the user to search for the keycode they would like to add to the sales order.

: opens the Keycode Lookup dialog enabling the user to search for the keycode they would like to add to the sales order. : removes the keycode from the sales order.

: removes the keycode from the sales order.

: opens the Keycode Lookup dialog displaying all the alias and discount keycodes that the customer is entitled to so they can be added to the sales order.

: opens the Keycode Lookup dialog displaying all the alias and discount keycodes that the customer is entitled to so they can be added to the sales order. : removes the discount or alias keycode from the Discount Codes grid.

: removes the discount or alias keycode from the Discount Codes grid.

Discount Codes Grid

- Keycode: code of the keycode.

- Alias Code: the unique code of the alias keycode that the customer can use.

Discount Codes Context Menu

- Goto Keycode: opens up the keycode screen for the keycode currently focused on in the grid.